Asian stock markets have been on a rollercoaster ride recently, influenced by various economic data releases and geopolitical tensions. The recent soft consumer inflation readings in the US have led to speculation about interest rate cuts in 2024, creating a sense of optimism among investors. However, challenges from countries like China and Japan, coupled with trade tensions, have added a layer of uncertainty to the market outlook.

The Japanese economy has been grappling with a series of setbacks, as evidenced by the significant contraction in the first quarter of 2024. Factors such as sticky inflation and laggard wages have hampered private consumption, leading to a slowdown in capital expenditures. This weak economic performance has raised concerns about the Bank of Japan’s ability to tighten policy effectively. While loose monetary policy might support stock markets, a sluggish economy poses significant challenges.

China, one of the key players in the Asian market, has faced its own set of challenges due to escalating trade tensions with the US. The Biden administration’s decision to impose higher trade tariffs on key Chinese sectors like electric vehicles and solar energy has strained relations between the two economic powerhouses. This move has not only impacted sentiment towards China but also raised fears of a potential trade war that could have far-reaching implications for the global economy.

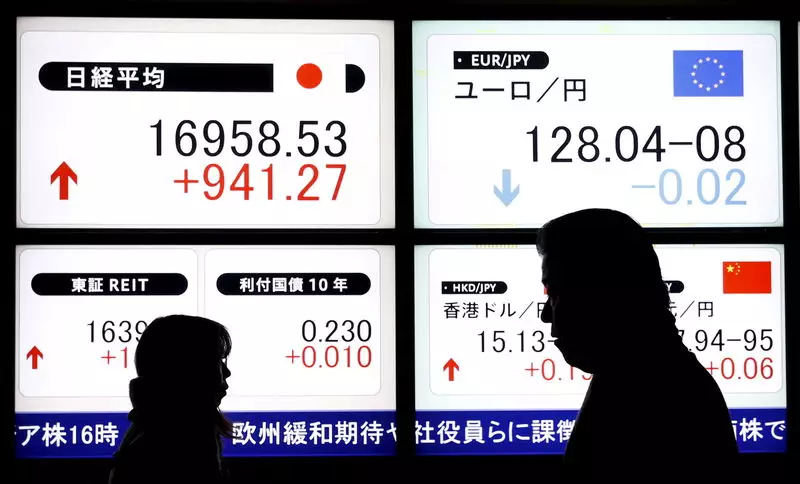

Despite these headwinds, various Asian markets have shown resilience and posted gains. The Nikkei 225 index in Japan rose, supported by technology stocks, while other sectors faced setbacks. China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes saw modest gains, reflecting cautious optimism among investors. Hong Kong’s Hang Seng index also recorded an increase, albeit lower than its regional counterparts.

Australian markets emerged as the standout performer, with the ASX 200 rallying close to record highs. However, unexpected increases in the country’s unemployment rate have raised concerns about the labor market’s stability. South Korea’s KOSPI index also saw gains, driven by strong performances in the technology sector. India’s Nifty 50 index is poised for a positive open, although caution prevails due to uncertainties surrounding the upcoming general elections.

The Asian stock markets continue to navigate through a complex web of economic data, geopolitical tensions, and trade uncertainties. While some markets have shown resilience and posted gains, challenges persist, threatening to derail the positive momentum. Investors need to closely monitor the evolving landscape and adapt their strategies to mitigate risks and capitalize on opportunities in this dynamic environment.