JP Morgan recently upgraded Apollo Tyres (APTY) to Overweight from Neutral, citing the company’s efforts to reduce debt and pursue disciplined growth strategies. Despite a slight margin miss in the 4QFY24 results, APTY has already announced price increases to offset the impact of environmental protection requirements (EPR) and commodity inflation. The company has shown strong free cash flow (FCF) conversion, exceeding 100%, which demonstrates its financial resilience.

The recent decline in APTY’s stock price, down 12% since the 3Q results while Nifty Auto has seen a 16% increase, reflects concerns over commodity inflation and higher environmental costs. Although 1HFY25 margins may face pressure, JP Morgan expects price hikes and lower interest expenses to boost full-year earnings, projecting a 13% year-on-year increase.

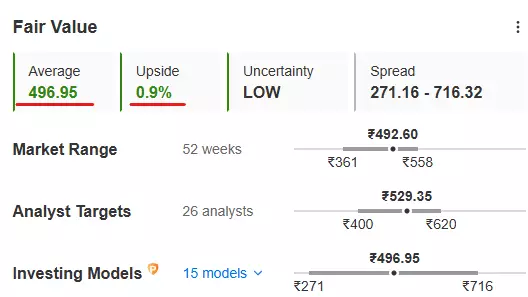

Despite maintaining FY25/26E EPS estimates, JP Morgan has raised the price target to INR 555, extended to Jun-25. APTY’s current valuation stands at 13x FY26E P/E with a 7% FCF yield. However, analyzing the fair value of Apollo Tyres (NS:APLO) through complex financial models, the fair value comes at INR 469.95, indicating only a minor 0.9% upside from the current market price.

– Consolidated adjusted EBITDA of INR 11bn, up 10% year-on-year, slightly below JP Morgan estimates.

– India EBITDA, adjusted for EPR, missed by 2%, with flat year-on-year revenue offset by better-than-expected margins.

– Reported PAT at INR 3.5bn was 30% below JP Morgan estimates, primarily due to operating miss and EPR provisions.

– Net debt decreased to INR 25bn as of Mar-24, with a notable improvement in ROCE to 16% in FY24.

APTY management focuses on pricing adjustments to mitigate EPR and commodity inflation impacts, with a 3% price hike already implemented. The company aims for near-debt-free status by FY26, with strong growth potential in both India and the EU markets. However, risks include potential price competition in India, weakness in EU replacement tire demand, and a resumption of a large capex cycle.

While JP Morgan’s upgrade of Apollo Tyres to Overweight reflects confidence in the company’s strategic initiatives and financial performance, investors should consider the potential risks and valuation concerns highlighted by other analysts. It is essential for investors to conduct thorough research and analysis before making investment decisions in the volatile market environment.