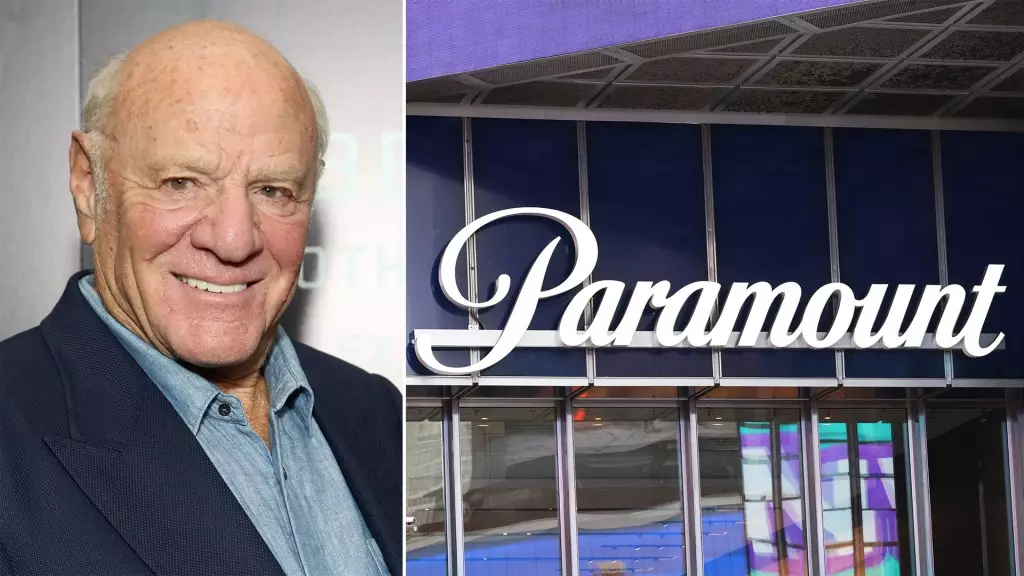

Barry Diller, media mogul and former head of Paramount Pictures, is reportedly exploring a bid for Paramount. The New York Times has reported that Diller’s company, IAC Corp., has signed nondisclosure deals with National Amusements Inc., the controlling stakeholder of Paramount. This news comes amidst ongoing talks between various potential buyers and Paramount.

The Paramount sale saga has been filled with twists and turns, including talks with previous suitors such as Sony, Edgar Bronfman Jr., and an investor group led by Steven Paul. Only Skydance and Apollo Global Management have discussed a full takeover of Paramount, with most parties looking to gain majority control of the company by taking over National Amusements.

Following the ousting of CEO Bob Bakish, a trio of executives has been installed to run Paramount Global as co-CEOs. The company has also hired bankers to sell its assets, indicating a shift in strategy. Despite recent challenges, the new leadership team remains confident in their strategic plan for growth.

Barry Diller, who has a long history in the entertainment industry, has shown interest in taking control of Paramount. Diller, who was once outbid for the company by Sumner Redstone, is now looking to acquire Paramount, which was previously in talks with David Ellison’s Skydance before negotiations fell apart.

The potential acquisition of Paramount by Barry Diller could have significant implications for both the company and the entertainment industry as a whole. Diller’s background in digital media ventures adds an interesting dynamic to the discussion and could signal a shift in direction for Paramount.

Barry Diller’s exploration of a bid for Paramount marks the latest chapter in the ongoing saga of the company’s sale. With multiple suitors and changing leadership, the future of Paramount remains uncertain. However, Diller’s interest adds another layer of complexity to the situation and opens up new possibilities for the iconic Hollywood studio.