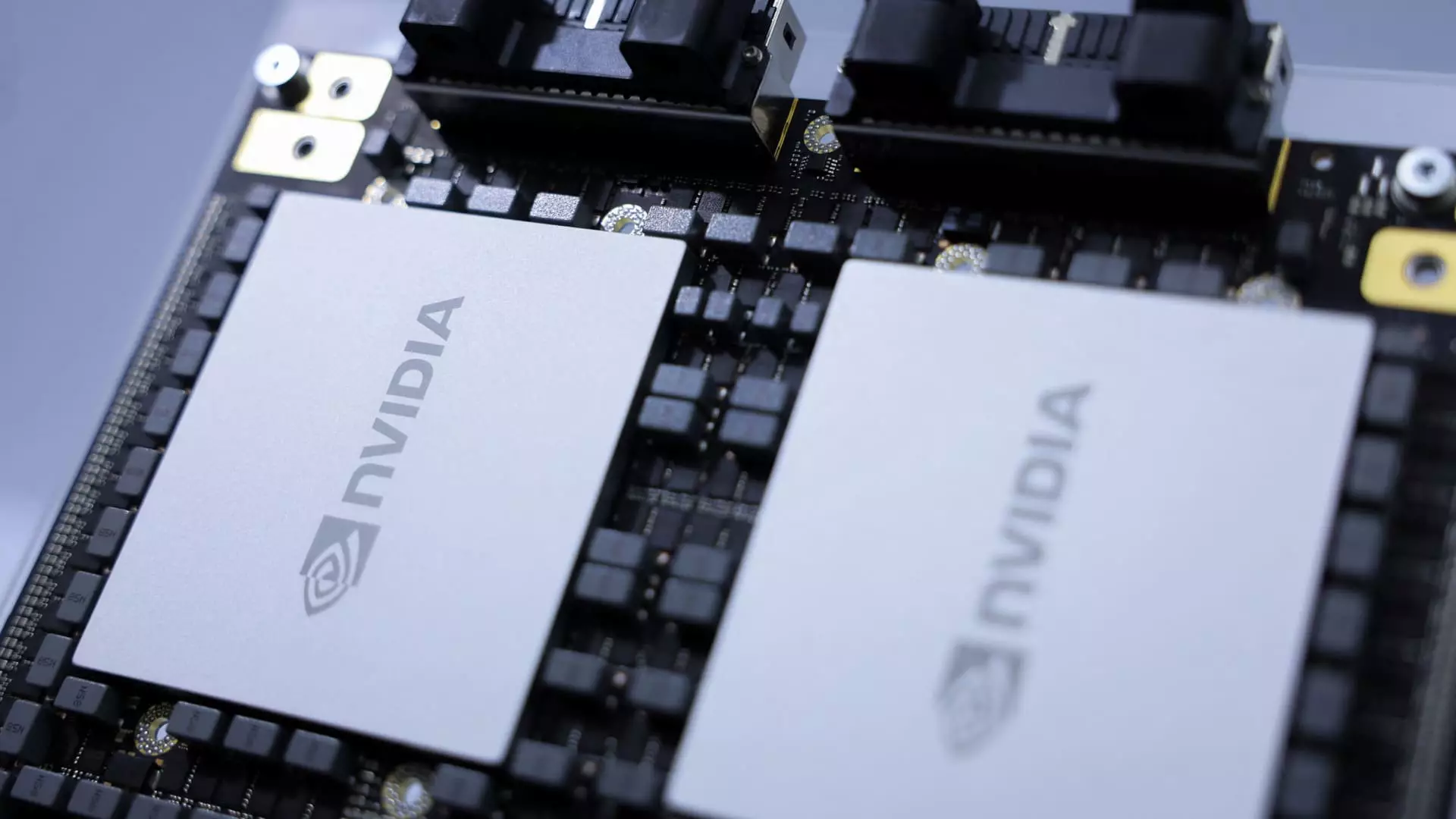

Nvidia has been making waves in the stock market, with its shares seeing a 1.8% increase following KeyBanc’s optimistic price target hike to $180. This move implies a significant 40% upside from Monday’s close. The firm’s positive outlook is based on the strong demand for Nvidia’s H100 chip, which has remained robust despite the impending launch of Blackwell in the second half of the year. This demonstrates the continued relevance and competitiveness of Nvidia in the artificial intelligence sector.

Helen of Troy: A Fall from Grace

Conversely, Helen of Troy saw a significant decline in its stock price, plummeting by nearly 28% and hitting a new 52-week low. This drop came in the wake of an earnings miss for the company’s first quarter of fiscal 2025. With earnings at 99 cents per share, excluding items, falling short of analysts’ expectations of $1.59 per share. In addition, the company also revised its full-year guidance downwards, painting a bleak picture for investors.

Another company facing challenges in the market is UiPath, which saw its stock price fall by 7% after announcing plans to reduce approximately 10% of its global workforce. Most of these reductions are expected to take place by the end of the first quarter in fiscal 2026. This move is part of a larger restructuring plan aimed at managing operating expenses and improving overall efficiency within the organization.

On a more positive note, Jumia Technologies experienced a significant uptick in its stock price, rising by 30% and hitting a new 52-week high. This surge came after Benchmark initiated coverage on the stock with a buy rating, setting a $14 price target that implies a substantial 65.5% upside from Monday’s close. The firm sees Jumia as being at an inflection point, citing demographic shifts in the region and the company’s strategic positioning as catalysts for future growth.

Chemours received a boost in its stock price, gaining 2% after being upgraded to a buy rating from neutral by UBS. The firm cited the potential for outperformance, pointing to favorable demand and price drivers heading into 2025. This upgrade reflects optimism in Chemours’ ability to capitalize on market conditions and deliver strong results in the near future.

In contrast, U.S.-listed shares of BP saw a decline of 4.5% after the company issued a warning regarding a potential impairment of up to $2 billion in the second quarter. The company also anticipates weak refining margins, which are expected to impact its earnings results. This challenging outlook has put pressure on BP’s stock performance in the market.

On a more positive note, Lucid, the electric vehicle company, saw a modest increase in its stock price, adding nearly 1% to its value. This gain followed a previous rally of about 8%, driven by the company’s announcement of delivering 2,394 vehicles in the second quarter, marking a significant 70% year-over-year increase. Lucid’s performance is indicative of the growing demand for electric vehicles in the market.

Novo Nordisk: Facing Tough Competition

Novo Nordisk, a health-care stock, faced challenges with a 1.7% decline in its share price. This decline came in the wake of a study published in JAMA Internal Medicine, which found that the active ingredient in Eli Lilly’s tirzepatide was more effective at weight loss than Novo Nordisk’s semaglutide. This competitive landscape has put pressure on Novo Nordisk’s stock performance in the market.

Sony saw a 4% increase in its share price following the news of Paramount Global’s parent company National Amusements and Skydance Media agreeing on a merger. This development attracted a bid from Sony and Apollo, signaling potential growth opportunities through strategic mergers and acquisitions in the industry.

Tesla continues to dominate the market, with its stock price surging by more than 4%. Morgan Stanley reaffirmed its overweight rating on Tesla, highlighting the company’s strong market position with a 15% share of the global battery electric vehicle market in May. This positive outlook has fueled Tesla’s impressive performance, setting the stage for continued success in the market.

Finally, Corning, the maker of specialty glass, saw a nearly 4% increase in its stock price. The company raised its expectations for second-quarter core sales to approximately $3.6 billion, up from its earlier outlook of around $3.4 billion. Additionally, Corning expects core earnings per share to be at the high end or slightly above management’s guidance of 42 cents to 46 cents. This positive revision reflects Corning’s confidence in its ability to deliver strong financial results in the upcoming period.

The midday stock market report offers a diverse range of performances from various companies, highlighting the volatility and opportunities present in the market. From companies experiencing challenges and setbacks to those garnering success and growth, the stock market continues to be a dynamic and ever-changing landscape for investors to navigate. Understanding these trends and developments is crucial for making informed investment decisions and capitalizing on emerging opportunities in the market.