As China’s highly anticipated “Third Plenum” gets underway, there are dire predictions regarding the constraining of the financial sector, especially in light of the country’s slowing economic growth. The focus is shifting towards reinforced support for high-tech and manufacturing, areas that are expected to see continued success in the coming years. It is believed that this shift will have a positive impact on investors, as the direction of government spending becomes clearer. However, there are concerns about subdued growth in the near term as Beijing prioritizes longer-term goals.

Policy has always played a crucial role in guiding investors in China’s top-down economy. In recent years, Beijing has made it clear that it wants to address excessive financial speculation, particularly in sectors like real estate. According to Han Wenxiu, finance should return to its original purpose of serving the real economy, rather than becoming detached from reality through excessive speculation. This shift in policy is aimed at preventing a shift from the real economy towards the financial economy, as outlined in a widely read article last month.

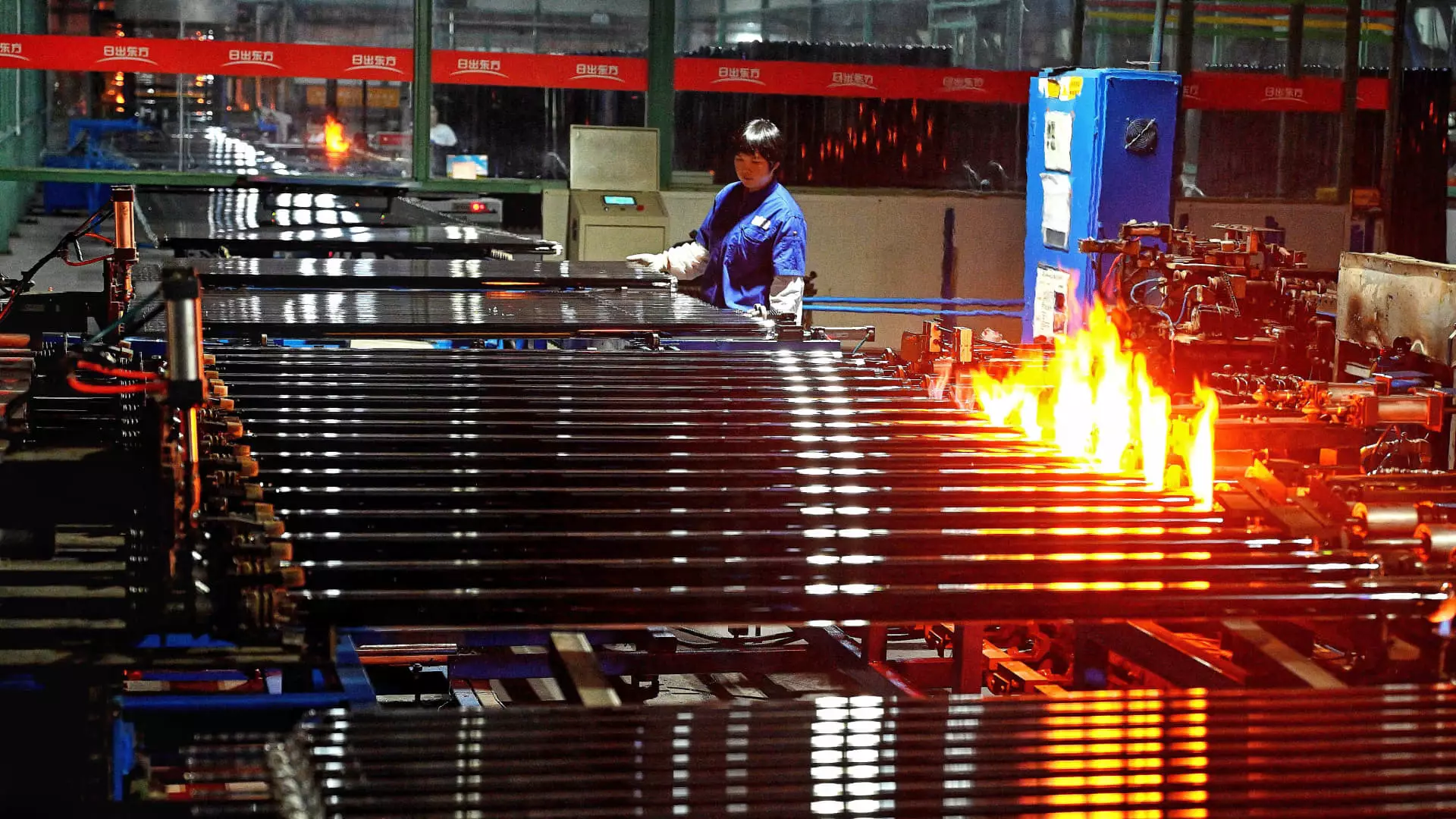

The upcoming Third Plenum is expected to focus on several key areas that are crucial to China’s long-term economic success. These include promoting technology self-sufficiency, addressing demographic challenges, and improving the social welfare system. China’s global tech advantages, particularly in sectors like new energy vehicles, lithium batteries, and solar power, have been highlighted by state media.

Goldman Sachs recently published a report on China’s solar industry, predicting that the sector is approaching a bottom. They point to encouraging signs of policy changes aimed at curbing new capacity and predatory pricing, which could benefit industry leaders with strong balance sheets, R&D capabilities, and cost advantages. Companies like Daqo New Energy, a U.S.-listed manufacturer of polysilicon, have been identified as potential long-term winners in the solar sector.

Analysts at Goldman Sachs have identified opportunities in small-cap Chinese stocks that are aligned with Beijing’s policy directives and have a high level of R&D intensity. Companies like IKD, an auto parts manufacturer, and Autowell, a producer of equipment for solar, lithium battery, and semiconductor factories, have been highlighted as promising investments. These companies are expected to benefit from China’s focus on supply chain development and high-tech manufacturing.

Challenges and Uncertainties

While China’s emphasis on technology and manufacturing is seen as a unique strength, there are also challenges and uncertainties on the horizon. Improving productivity will be key to achieving long-term success, but financial risks remain a concern. Relying solely on infrastructure or housing development will not be sufficient to transition China into a modern society with high-income levels. Therefore, the country must navigate these uncertainties carefully to ensure sustainable growth.

China’s economy is at a critical juncture, with the government making significant policy shifts to address key challenges and capitalize on emerging opportunities. By focusing on technology, manufacturing, and innovation, China aims to drive long-term growth and establish itself as a global economic powerhouse. However, as with any economic transition, there are risks and uncertainties that must be carefully managed to ensure a successful outcome.