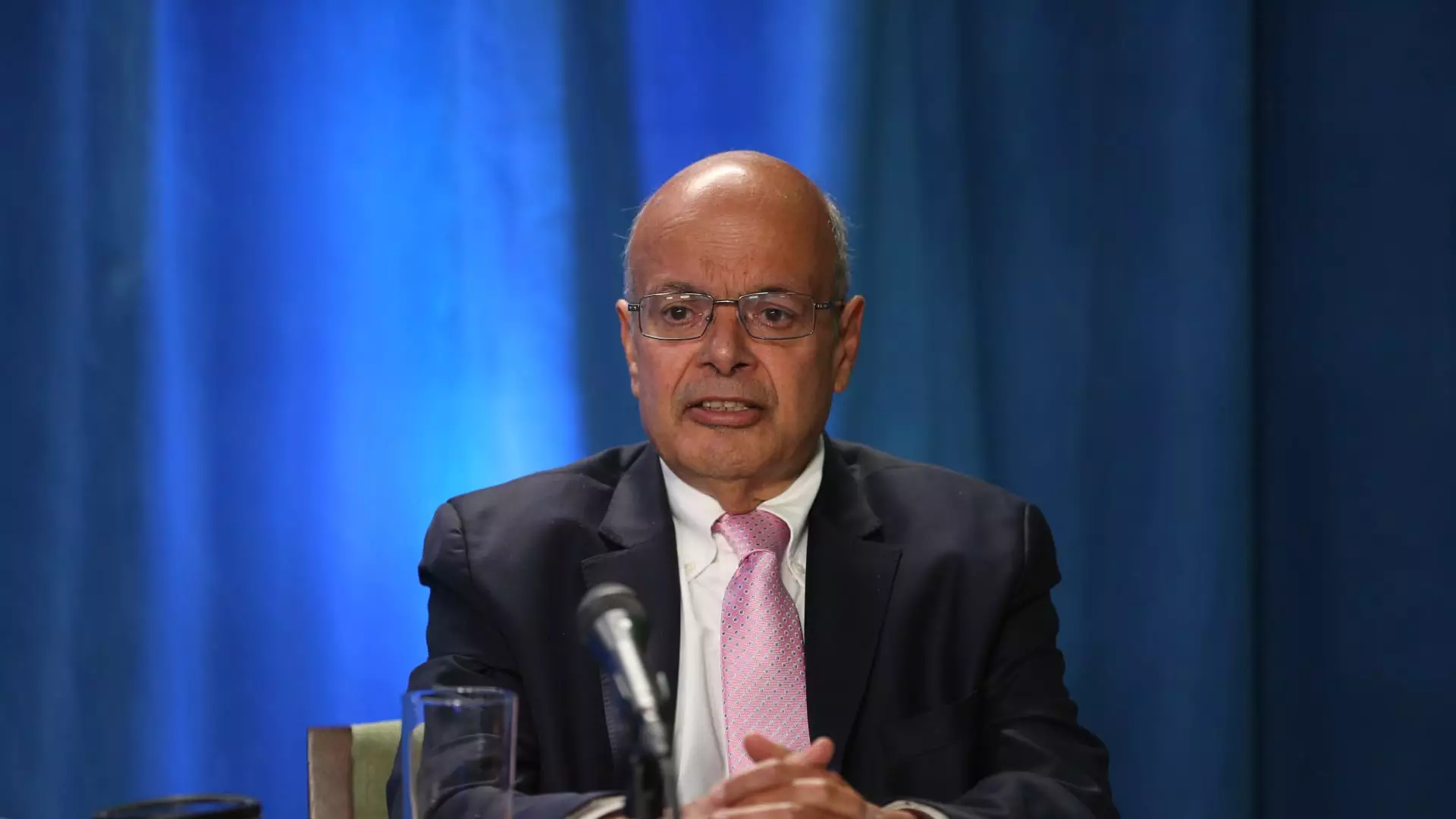

The recent regulatory disclosure revealing Ajit Jain’s divestment of over half of his Berkshire Hathaway shares has sparked widespread speculation within the financial community. As Warren Buffett’s right-hand man and the vice chairman of insurance operations, Jain’s actions carry significant implications for the investment conglomerate and its stakeholders. This decision, marking a notable decline in his investments after a tenure that began in 1986, prompts an exploration into the motivations and potential consequences of his sale.

On a day when Berkshire Hathaway shares were notably high, Jain sold 200 Class A shares at an approximate average of $695,418, amounting to about $139 million. This transaction reduces his direct stake to merely 61 shares, while various family trusts and the Jain Foundation collectively hold an additional 105 shares. The sale accounts for an impressive 55% of his total holdings in the company. Such a drastic reduction in stake raises eyebrows, particularly in an organization accustomed to the steady hand of its long-term leaders.

The context of this sale is vital. Recently, Berkshire’s stock crossed the significant threshold of $700,000 per share, pushing its market capitalization to a staggering $1 trillion by the month’s end. This spike in stock price suggests that Jain may have seized an opportune moment to capitalize on the high valuation. Industry experts, including finance professor David Kass, have hypothesized that Jain’s decision might indicate a belief that Berkshire shares are nearing their value ceiling, leading to this strategic divestment.

The timing and volume of Jain’s share sale signal a possible cautionary stance on Berkshire’s valuation. Bill Stone, CIO at Glenview Trust Co., noted that with the shares trading at over 1.6 times their book value, they are likely reflecting Buffett’s conservative intrinsic value estimates. This sentiment is echoed in the significant slowdown in Berkshire’s stock repurchase activity, which dipped from $2 billion in the preceding quarters to just $345 million, further suggesting a strategic reconsideration of valuation tactics at the conglomerate.

Ajit Jain’s legacy at Berkshire Hathaway is irrefutable. A pivotal figure in Berkshire’s expansion into reinsurance, as well as instrumental in revitalizing Geico, Jain has earned the reverence of Buffett himself. The acknowledgment of Jain’s contributions by Buffett, particularly the statement that he would willingly swap roles with Jain, underscores the immense value Jain has added to the corporation. As a trusted lieutenant, Jain played a key role in shaping Berkshire’s insurance operations, which have become central to its diversified portfolio.

The conversation surrounding Berkshire’s future leadership has ignited speculation about potential successors following Buffett’s eventual retirement. While Jain was previously viewed by some as a strong candidate for leadership, Buffett has dispelled those notions, affirming that Jain has never aspired to head the company. Instead, the focus has shifted to Greg Abel, who is positioned to take the reins of Berkshire’s non-insurance operations. This clarification from Buffett further delineates the dynamics within Berkshire’s upper management as the company prepares for a significant transitional period.

Ajit Jain’s recent sale of a majority of his Berkshire Hathaway shares may be interpreted in myriad ways, but what remains clear is its reflection of an evolving philosophy within the conglomerate amid changing market conditions. As Berkshire enters an important transition with emerging leadership dynamics, the implications of Jain’s actions will undoubtedly continue to be scrutinized. Investors and analysts alike will be closely watching how these changes influence the company’s strategies, share value, and overall corporate trajectory in the coming months.