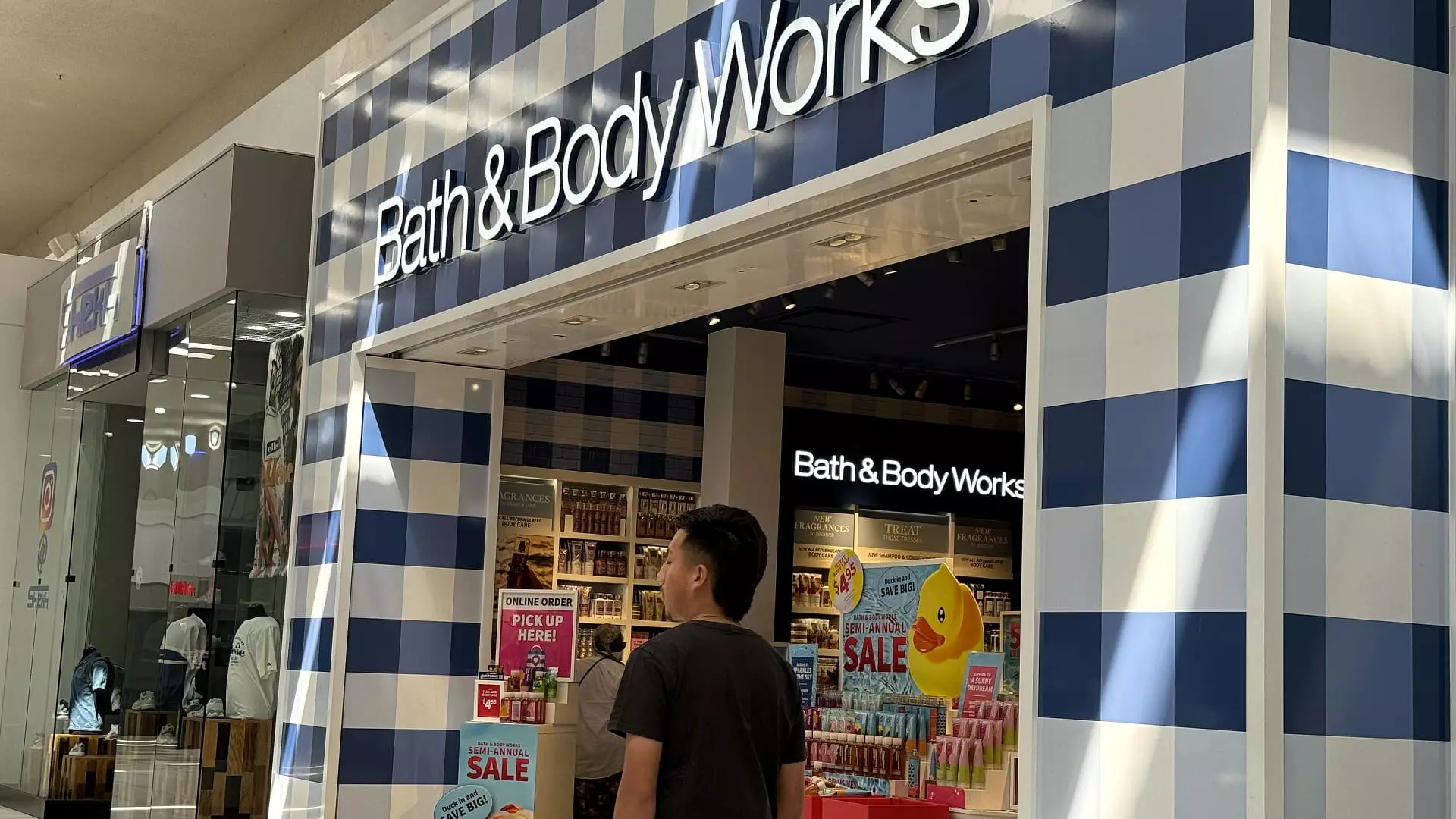

In the latest pre-market trading session, Bath & Body Works has become a focal point as its shares climbed 16%. This robust increase can be attributed to the retailer’s impressive third-quarter earnings, which surpassed analysts’ expectations. The company reported earnings per share (EPS) of 49 cents, outshining the anticipated 47 cents, alongside a revenue of $1.61 billion compared to the forecasted $1.58 billion. This performance underscores the brand’s resilience in an increasingly competitive market, particularly during the holiday season, when consumer spending typically peaks.

Robinhood: Analysts Optimistic After Upgrade

Following an upgrade from Morgan Stanley, Robinhood’s stock saw a significant increase of over 7%. The brokerage firm changed its rating from equal weight to overweight, suggesting that Robinhood could benefit from heightened trading activities post-election, particularly in the stock and cryptocurrency sectors. This outlook demonstrates a potential rebirth for the company, which has faced considerable scrutiny and challenges in recent quarters. Capitalizing on increased trading volume could lead to stronger revenue growth, positioning Robinhood as an attractive investment option once again.

Conversely, Macy’s shares experienced a 3% drop due to an unsettling revelation involving intentional accounting misstatements. The retailer disclosed that an employee had manipulated financial entries for years, ultimately disguising substantial delivery expenses totaling between $132 million and $154 million. Despite these issues, Macy’s reassured stakeholders that the errors have not significantly impacted its cash position. However, trust is paramount in retail; such revelations can have lasting implications on investor sentiment and customer confidence.

Abercrombie & Fitch: Anticipation Ahead of Earnings

Another company making waves is Abercrombie & Fitch, which saw a 3% rise in its stock as investors await its third-quarter earnings report. With analysts forecasting EPS of $2.39 and revenue of around $1.19 billion, expectations are running high. Strength in the apparel sector, particularly after Gap’s optimistic guidance, indicates that Abercrombie could be poised for a positive performance. The brand’s recent revival resonates well with consumers, suggesting a bright outlook ahead as the holiday season approaches.

Target: A Strategic Choice for Investors

In a favorable turn for Target, shares gained nearly 2% following an endorsement from Oppenheimer as a top investment pick. The firm emphasizes an attractive risk-to-reward profile, particularly noteworthy given Target’s 12% decline this year. The stock’s appealing dividend yield adds to its attractiveness, enhancing its status as a solid option for yield-seeking investors.

MicroStrategy: Bitcoin Enthusiasm Drives Stock Increase

MicroStrategy experienced a noteworthy 3% jump in its stock price after Bernstein raised its price target significantly from $290 to $600. The bullish sentiment surrounding its stock highlights a potential upside exceeding 40%. As a frontrunner in the bitcoin development sector, MicroStrategy has seen its shares skyrocket by approximately 568% this year, reflecting the growing institutional interest in cryptocurrency.

Two other companies also experienced upward movement: Sally Beauty saw nearly a 3% increase post-upgrade to buy from hold, attributed to strong cash flow and appealing valuation. Similarly, Santander’s stock gained 2% following an upgrade from Morgan Stanley, reinforcing confidence in its capital generation capabilities.

The pre-market trading landscape reflects a mix of optimism and caution as various companies navigate financial hurdles and market opportunities. The interplay between earnings reports, analyst upgrades, and emerging trends will continue to shape stock performance in the coming weeks.