The stock market is a dynamic entity, constantly evolving and influenced by various factors ranging from earnings reports to new product announcements. In midday trading today, several companies caught the investor’s eye, with movements that could signal significant trends or shifts in their respective industries. Understanding these shifts is critical for both investors and market analysts alike, opening a window into potential future performance.

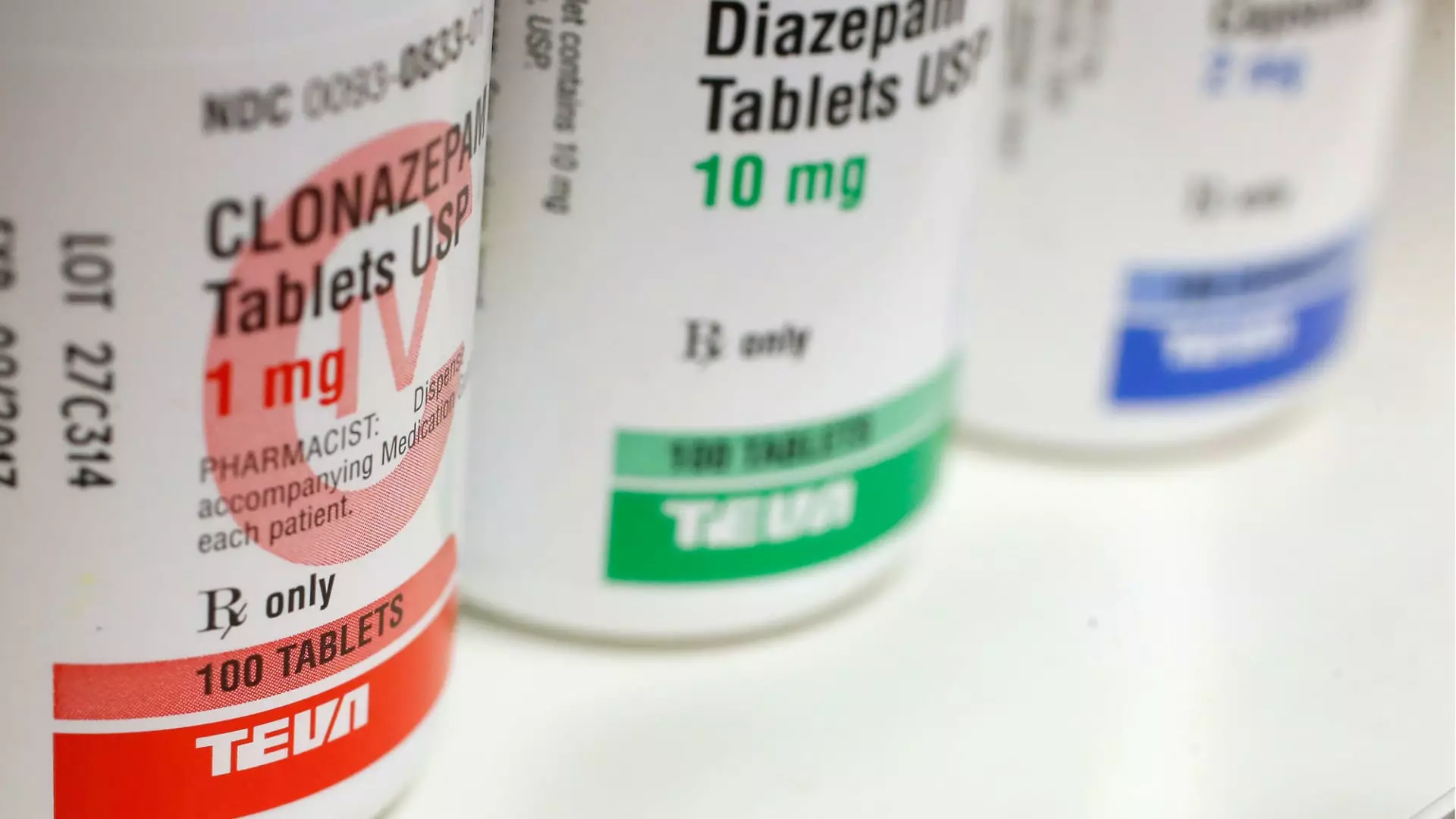

Teva Pharmaceuticals and Sanofi saw their shares surge dramatically, with Teva experiencing a staggering 23% increase and Sanofi following at a robust 6%. This uptick comes on the heels of promising Phase 2b trial results for their collaborative drug, duvakitug, aimed at treating moderate to severe inflammatory bowel disease. Such significant gains represent more than just a positive trial; they indicate investor confidence in the drug’s potential market impact and a possible therapeutic breakthrough. The success of duvakitug could lead to increased sales forecasts and market share for both companies, positioning them strongly in a competitive industry that continues to evolve.

Pfizer’s shares edged up nearly 4% as the biopharmaceutical company’s 2025 revenue outlook aligned with Wall Street projections, estimating earnings between $61 billion and $64 billion. This consistency suggests that Pfizer is managing its product pipeline effectively, maintaining investor trust in its operational strategy during uncertain economic times. The fact that its projections are consistent with consensus estimates reflects a level of stability that can often be hard to achieve in this volatile market, especially post-COVID-19 as healthcare dynamics shift.

In a remarkable move, Quantum Computing’s stock soared by more than 38%, reaching a new 52-week high. This surge follows the announcement of a critical contract from NASA’s Goddard Space Flight Center, which has chosen Quantum’s Dirac-3 for advanced imaging and data processing tasks. This breakthrough not only highlights the significance of quantum computing in practical applications but could also establish Quantum as a leader in the industry. The intrinsic value of having a government agency like NASA as a client can lead to more trust from investors, potentially inviting further contracts from both governmental and commercial sectors.

SolarEdge Technologies experienced a robust 21% stock increase due to a double upgrade from Goldman Sachs, moving from sell to buy. Analysts noted that 2025 represents a pivotal inflection point for the clean energy firm, suggesting they anticipate considerable growth and evolution within the company. This optimism is rooted in the broader market trends toward renewable energy and sustainable practices, which continue to be prioritized by both consumers and shareholders. As regulatory environments become more favorable, companies like SolarEdge stand to benefit significantly.

The tech sector displayed mixed results, with Nvidia and Broadcom experiencing declines of over 1% and nearly 5%, respectively. Nvidia entered correction territory, signaling potential concerns over its future performance following recent highs. Conversely, despite the dip, Broadcom reported better-than-expected fourth-quarter earnings, especially impressive given its rise over the past week to a market cap above $1 trillion. This dichotomy illustrates the fluctuating nature of tech stocks, where individual company performance can rapidly shift investor sentiment, often regardless of broader market trends.

Red Cat, a player in the drone technology space, faced a 12% drop after a disappointing fiscal second-quarter report that showed a larger-than-expected loss. However, with recent drone sightings in New Jersey generating investor excitement, the stock has shown resilience, up about 17% in the past week. This contradiction illustrates the emotional nature of stock trading, where buzz and fear can drive prices, sometimes independent of actual financial performance.

As the midday trades illustrate, the landscape of stock performance is riddled with both opportunities and risks. From the promising moves of pharmaceutical giants to the volatile behavior of tech stocks, astute investors should remain vigilant, synthesizing information and market signals to shape their investment strategies. In such a fast-paced environment, understanding the motivations behind stock movements can illuminate paths forward, helping to navigate the complexity of modern finance.