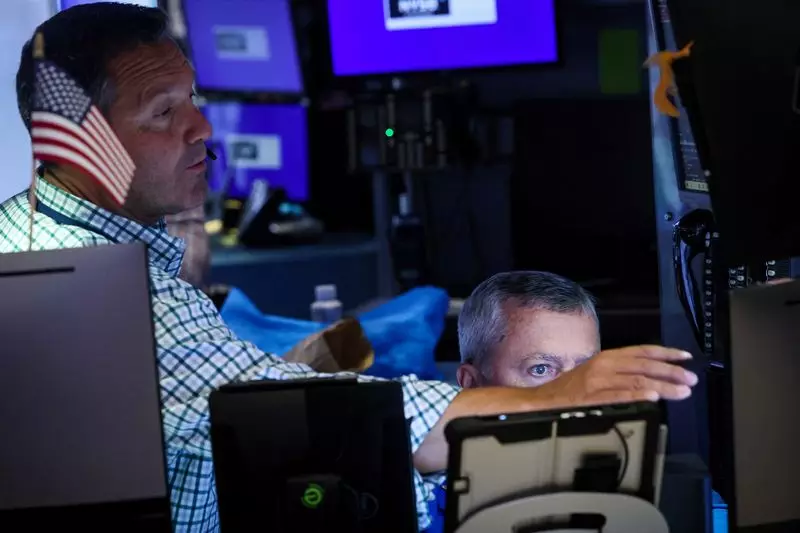

Wall Street’s main indexes took a hit recently due to a sell-off driven by tech stocks and mixed earnings reports. The sell-off was further intensified by a global cyber outage that affected CrowdStrike’s shares, causing them to drop to an over two-month low. This incident had a domino effect on tech giant Microsoft as well, as an update to one of CrowdStrike’s products triggered an outage that disrupted businesses across sectors, including major U.S. airlines. The Euronext exchange and London Stock Exchange Group’s Workspace news and data platform also faced issues due to this cyber outage.

The market reaction to this sell-off and cyber outage was reflected in the performance of tech stocks, with Microsoft slipping to an over one-month low and facing a four-day decline. The overall sentiment among investors, as highlighted by Phil Blancato, CEO of Ladenburg Thalmann Asset Management, is that tech stocks are priced to perfection and any hint of bad news can significantly impact their performance. Amidst the sell-off, megacap stocks like Nvidia, Amazon.com, Apple, and Google were largely mixed, showing investor uncertainty regarding the future direction of the market.

The recent market volatility was further evident in the performance of the Nasdaq and S&P 500, which both dropped significantly over the past two sessions. This downward trend put the indexes on track for weekly losses, signaling investor unease and uncertainty about the future direction of the market. The VIX, Wall Street’s “fear gauge,” was trading at its highest level since early May, indicating heightened investor anxiety and apprehension.

Investors are closely watching for comments from Federal Reserve officials John Williams and Raphael Bostic for hints on the future policy path. Market expectations suggest a 25-basis-point interest-rate cut by September, with two cuts expected by year-end. This anticipation is based on current market conditions and economic indicators, as investors assess the impact of recent market events on the broader economy and financial landscape.

Among the stock performance highlights, cybersecurity shares like Palo Alto Networks and SentinelOne saw gains, while pharmaceutical company Eli Lilly and medical device company Intuitive Surgical also experienced positive movements. Netflix, on the other hand, faced challenges with a 1% decline in choppy trading, citing lower third-quarter subscriber additions. Overall, the S&P 500 healthcare index led sectoral gainers, showing resilience amidst market uncertainties.

The recent Wall Street sell-off driven by tech stocks and mixed earnings, combined with the global cyber outage impacting CrowdStrike and Microsoft, has led to increased market volatility and investor unease. As investors await announcements from Federal Reserve officials and track market expectations, it remains crucial to monitor stock performance and sectoral trends for insights into the future direction of the market.