European corporate earnings are facing uncertainty due to the political situation in France. President Emmanuel Macron’s decision to call parliamentary elections has raised doubts about the country’s fiscal discipline under new governments. Concerns about tax and minimum wage rises have shaken confidence in French blue-chip firms, leading to a decrease in earnings expectations and European shares in recent weeks.

Despite forecasts of a 2% rise in second-quarter earnings for companies in the pan-European STOXX 600, investors remain cautious. The European Central Bank’s loosening policy and improving economic outlook were contributing factors to a positive sentiment in Europe’s equity markets. However, Macron’s decision to dissolve parliament has triggered concerns, with the STOXX 600 index down 2.5% from its peak.

Impacts on Markets

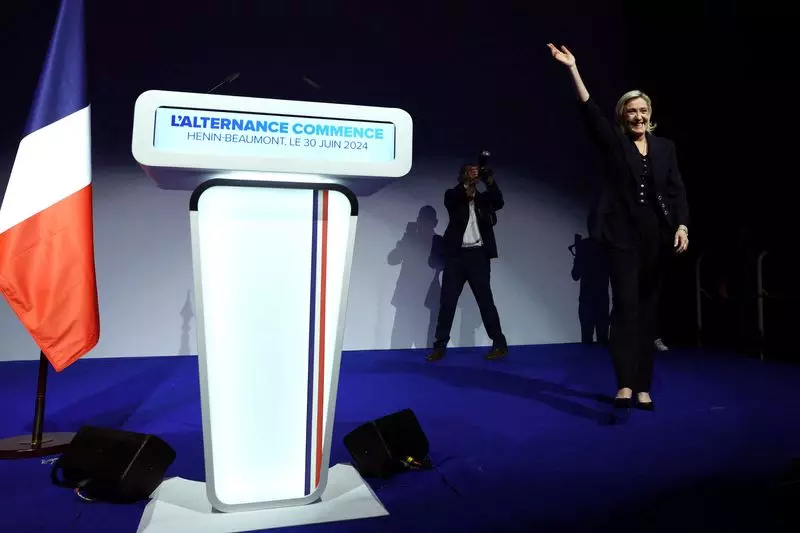

Analysts have noted a shift in investor interest away from European markets, particularly in France, following Marine Le Pen’s National Rally party’s win in the first round of parliamentary elections. Political risks have resulted in outflows from European funds, with market participants closely monitoring the situation. Citigroup recently downgraded continental European stocks to neutral in its global equity strategy due to ongoing political uncertainties.

As the broader European market hovers near all-time highs, investors are seeking reassurance from companies with optimistic outlooks. However, the escalating trade tensions between the European Union and China, along with the uncertainty surrounding political developments, are clouding the picture. German industries, particularly autos and industrials, are at risk due to the trade disputes and potential repercussions on the economy.

While there were initial signs of improvement in the eurozone’s manufacturing activity, recent data suggests a mixed outlook. Citi’s economic surprise index has turned negative for the first time since January, indicating challenges ahead. The Ifo Institute survey showing a decline in German business morale adds to concerns about the recovery in the euro area’s largest economy.

The European corporate earnings landscape is facing uncertainty due to political developments in France and escalating trade tensions between the EU and China. Investors are closely monitoring the situation and adjusting their strategies accordingly. Companies will need to navigate through these challenges and provide clear guidance to maintain investor confidence in the midst of a complex and ever-changing environment.