China’s economic landscape creates a tapestry of complexities, particularly as the nation grapples with structural challenges that inhibit growth and consumer confidence. Despite a series of government interventions designed to rejuvenate economic activity, tangible improvements have yet to manifest. Investors and economic analysts remain vigilant, urging a cautious approach as the nation’s post-pandemic recovery seems slow and fraught with hurdles.

In an effort to stimulate the economy, Chinese policymakers have recently reduced interest rates and introduced stimulus plans aimed at reinvigorating growth. However, the specifics of these fiscal measures will not be unveiled until March during the annual parliamentary meeting. Ahead of these disclosures, BlackRock Investment Institute has expressed skepticism, noting that the initial stimulus package seems insufficient to counteract the ongoing economic headwinds. The firm highlighted the structural issues embedded in China’s economy and recommended a prudent investment strategy focused on Chinese stocks while remaining ready to reassess based on evolving circumstances.

The lack of consumer demand has emerged as a pressing issue, exacerbated by fears of deflation. In 2024, inflation rates for consumer goods hovered at a mere 0.5% when volatile food and energy prices were excluded. This represents the lowest inflationary increase in over a decade, signaling deep-rooted challenges within the market. Mayor Yin Yong of Beijing highlighted the persistent weakness in consumer spending alongside a marked decline in foreign investment, illustrating the broader difficulties faced at the national level.

China’s forthcoming economic policies seek not only to stimulate demand but also to address the real estate crisis that has lingered since regulatory actions commenced in 2020. The real estate sector, once the cornerstone of economic growth, has been under severe strain due to tightened credit and a crackdown on developer debt. This has had cascading effects across ancillary sectors, including construction and household consumption.

To combat these challenges, authorities are considering additional direct supports for the beleaguered real estate sector. This initiative aims to complete numerous unfinished housing projects, which could reinvigorate consumer investment in real estate. However, market analysts from various firms remain skeptical about a complete turnaround – many expect prices to continue their downward trajectory in multiple cities, fueled by burgeoning housing inventories.

Interestingly, in stark contrast to Western models employed during economic downturns, China has opted against direct cash handouts to citizens. Instead, it has launched trade-in subsidy programs aimed at reviving consumer interaction with the market. These programs encompass significant discounts and financial incentives for upgrading home appliances and electric vehicles, suggesting a strategic push to foster consumer spending without draining state resources. Nevertheless, there are doubts surrounding the long-term effectiveness of these initiatives as experts predict that any initial sales increase might dwindle as the year progresses.

Tensions with Western nations, particularly the United States, are contributing to a more insular economic policy in China. The government’s push for national security has intensified, and there is an evident trend toward favoring homegrown companies within critical sectors. This approach is forcing many foreign firms, especially those from Europe, to localize operations, which comes with increased expenditures and productivity concerns.

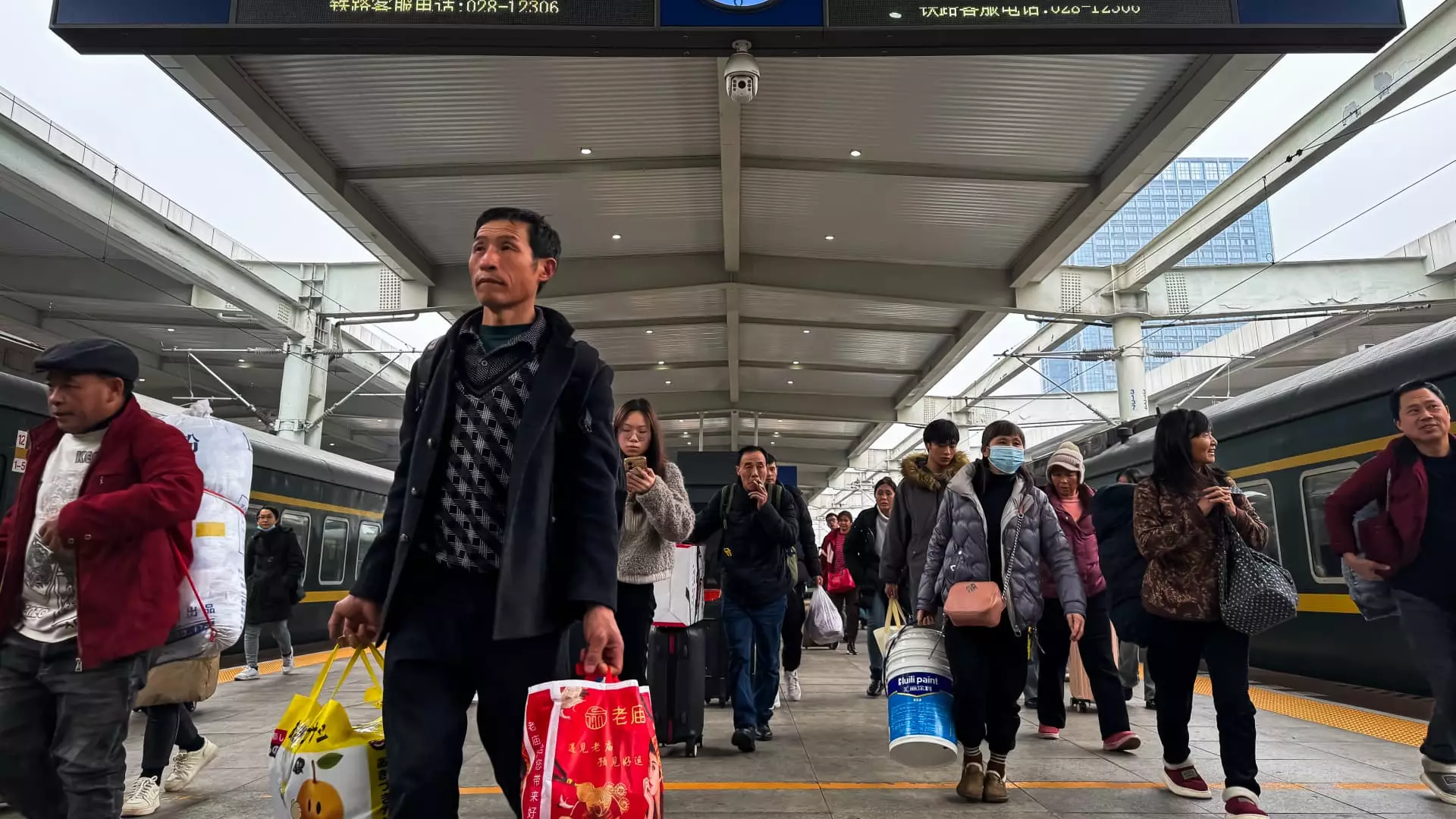

As China strives to navigate these challenges, officials have made it clear that nurturing domestic consumption is paramount. The government appears committed to amplifying consumption in the year ahead while assessing the broader implications of its evolving relationship with international trade partners.

The forecast for 2024 is steeped in uncertainty; the release of GDP figures will provide necessary insights into the success of current policies. Analysts remain watchful, prepared to adjust their perceptions based on new data and shifting economic conditions.

China’s current approach to economic recovery is an ambitious but delicate balancing act, influenced heavily by global economic dynamics and internal market pressures. Stakeholders are encouraged to monitor these developments closely, as the interplay between policy adjustments and market reactions may yield critical insights into the future of the Chinese economy. In this period of flux, the emphasis on fostering consumption while managing the fallout from previous regulatory measures will be crucial in determining how effectively China can instigate a resilient economic rebound. As policies take shape post-March, only time will reveal their effectiveness and sustainability amidst ongoing challenges.