In a world increasingly reliant on digital transactions, the rise of online fraud poses a significant challenge for consumers and financial institutions alike. British financial technology firm Revolut recently voiced strong criticism against Meta, the parent company of Facebook, for its perceived inadequate measures to address this pressing issue. The dialogue around fraud prevention has gained urgency, particularly as digital platforms become common breeding grounds for scams and fraudulent activities, impacting countless individuals and communities globally.

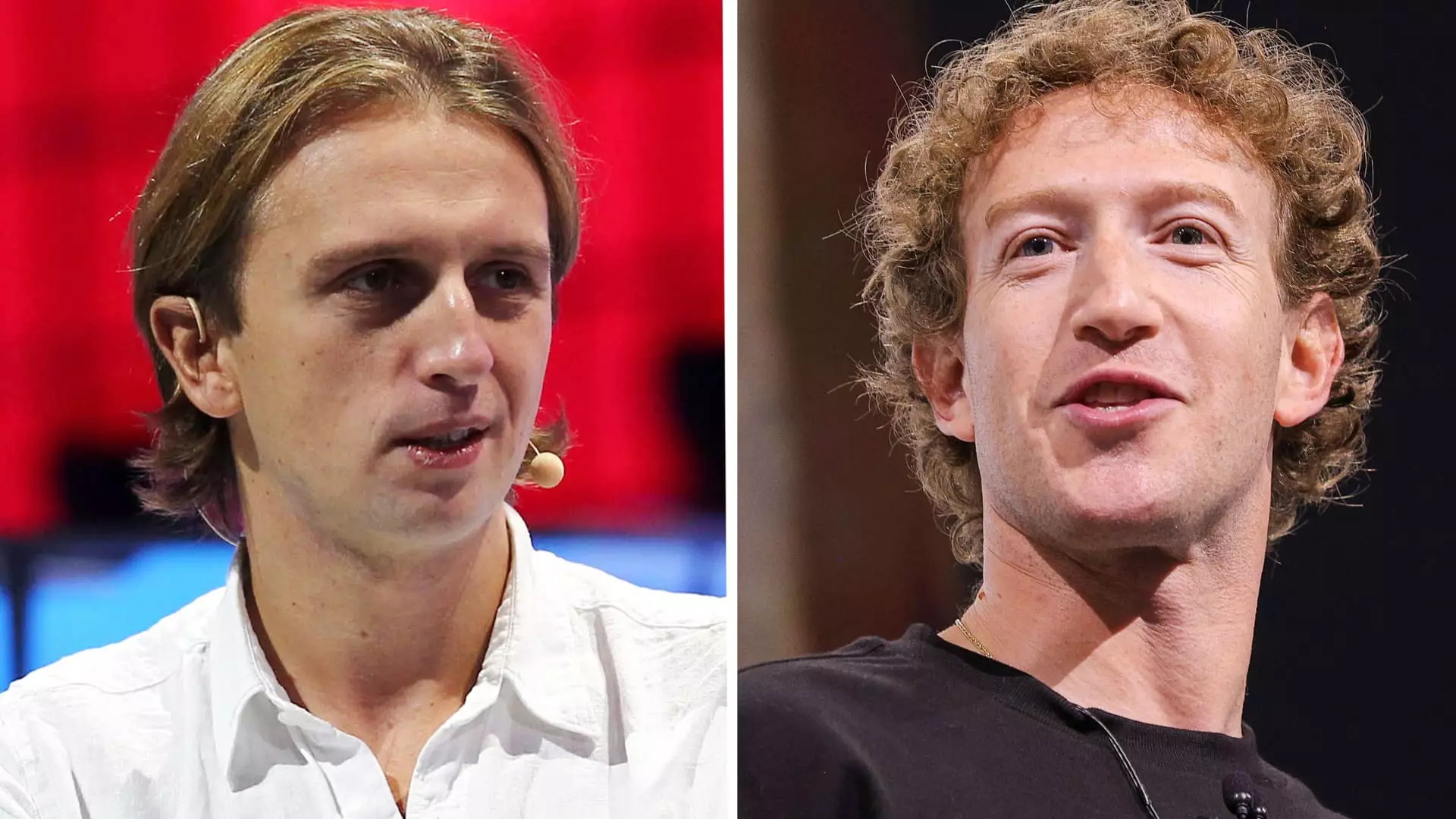

With the announcement of its recent partnership with U.K. banks like NatWest and Metro Bank, Meta highlighted its commitment to combating fraud through improved data-sharing protocols. While this initiative could potentially enhance fraud detection capabilities, Revolut’s head of financial crime, Woody Malouf, argues that such measures merely scratch the surface of what is necessary. Describing the partnership as “woefully short,” he emphasizes the need for Meta to take meaningful steps beyond mere data-sharing agreements.

By framing these initiatives as “baby steps,” Malouf underscores a critical point: companies that host substantial online interactions must take greater responsibility in protecting their users. The fact that Meta does not provide direct financial compensation to scam victims raises questions about the accountability of social media platforms in fostering a secure environment for their users. If the risk of significant financial loss exists, then it stands to reason that these companies should be incentivized to implement more robust protective measures.

As part of the U.K. government’s ongoing efforts to combat fraud, new reforms will take effect on October 7, requiring banks and payment firms to compensate victims of authorized push payment (APP) fraud up to £85,000 ($111,000). This regulatory shift signifies an attempt to compel financial institutions to take a more active role in safeguarding their customers. However, it also illustrates ongoing debates around the appropriate level of responsibility that should lie with tech giants like Meta.

Revolut’s Malouf reiterated the idea that tech companies should adopt a more proactive approach in addressing the aftermath of fraud that takes place on their platforms, thereby contributing to a safer digital ecosystem. The UK’s Payments System Regulator’s initial recommendation of a higher compensation cap of £415,000 was a testament to the magnitude of the issue. However, the scaling back of this figure in the face of pushback from the financial industry suggests a delicate balance between protecting consumers and maintaining the financial health of institutions.

The current landscape of fraud prevention underscores a critical gap that Revolut has become increasingly vocal about: the need for comprehensive solutions that involve all stakeholders. Online platforms like Meta must engage more proactively in discussions about cyber safety and user protection. This attitude is essential not only for improving public trust but to foster a collaborative approach in tackling fraud.

As the conversation continues, it is clear that a reimagining of responsibilities is necessary. For true progress to be made in the combat against financial fraud, tech companies, banks, and regulators must work together to address the vulnerabilities present in our current digital economy. Only through coordinated efforts can we hope to create a safer online environment for everyone.