GameStop recently announced plans to sell 45 million common shares of its stock, causing the share price to drop by more than 20%. In addition to the stock offering, the video game retailer also reported a sales decline in the first quarter. These developments have contributed to the volatility in GameStop’s stock price.

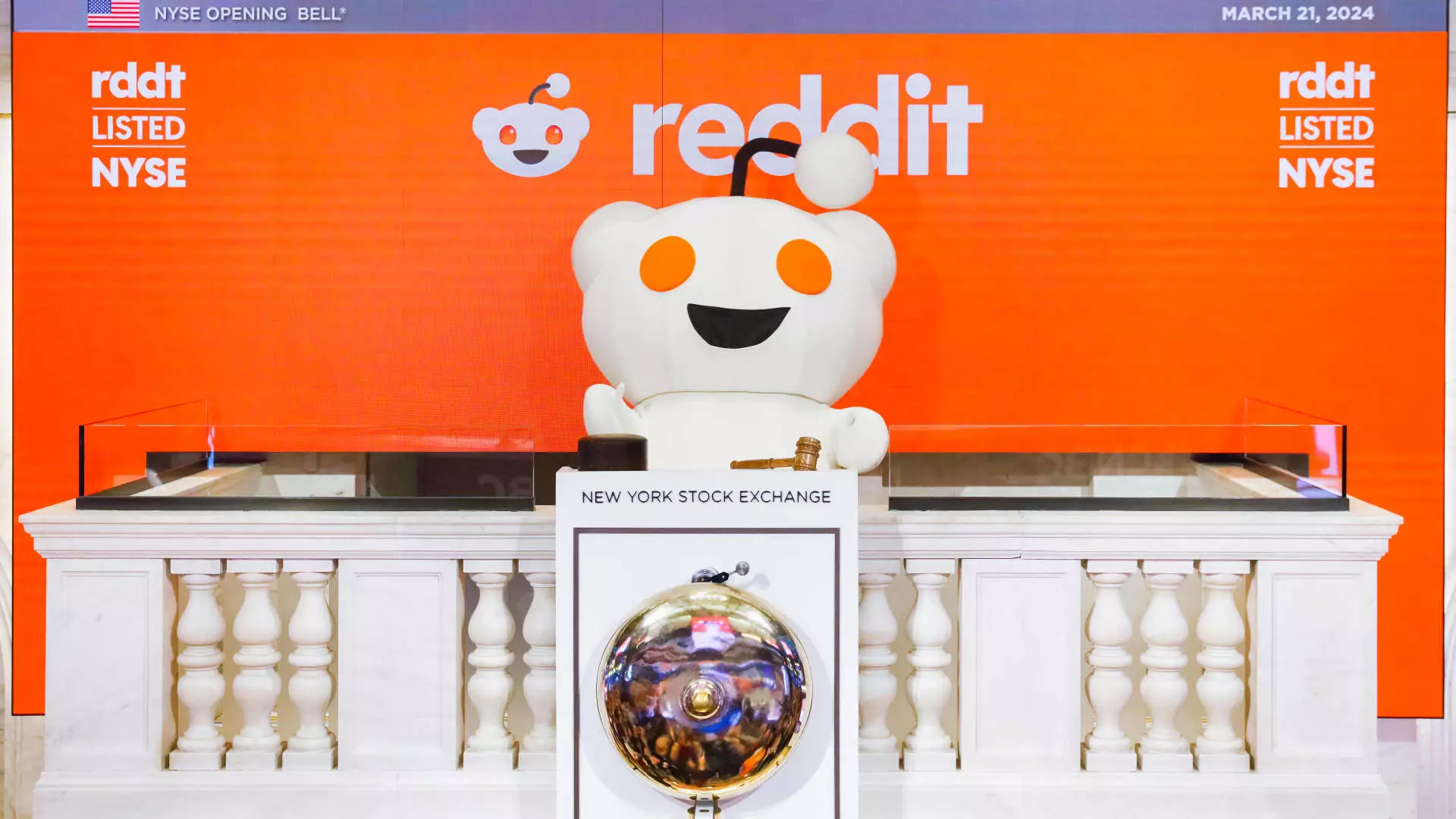

On a positive note, Reddit saw its stock rally by 10.5% after announcing a partnership with OpenAI. Under the agreement, Reddit will gain access to certain artificial intelligence features powered by OpenAI. In return, the ChatGPT maker will have access to Reddit’s Data API to enhance its AI models. This partnership has the potential to drive innovation and growth for both companies.

Take-Two Interactive Software Faces Setback with Grand Theft Auto Game Release

Shares of Take-Two Interactive Software dropped more than 2% following news about the delay in the release of the new Grand Theft Auto game. The company now anticipates launching the game in the fall of 2025, as opposed to the previous guidance of sometime in 2025. This delay has put pressure on Take-Two’s stock price.

Snowflake Eyes Acquisition of Reka AI

Snowflake, the cloud computing company, is reportedly in talks to acquire startup Reka AI for over $1 billion. While this potential acquisition could strengthen Snowflake’s technological capabilities, the stock edged lower by 0.3% on the news. Investors may be cautious about the financial implications of the acquisition.

Doximity Beats Estimates, Stock Surges

Doximity, an online networking company, experienced a nearly 18% surge in its stock price after beating fourth-quarter estimates. The company reported adjusted earnings per share of 25 cents and revenue of $118 million, surpassing analyst expectations. Doximity also provided in-line revenue guidance for the first quarter, demonstrating strong performance.

Globant SA saw its stock price drop by more than 3% after reporting second-quarter earnings and revenue guidance that fell short of estimates. While first-quarter results met expectations, the IT company’s guidance for adjusted earnings and revenue disappointed investors. This underperformance has led to a decline in Globant’s stock price.

Shares of Cracker Barrel Old Country Store tumbled nearly 15% after the restaurant chain announced an 80% decrease in its dividend. The dividend cut, from $1.25 to 25 cents, is part of the company’s strategic transformation plan. While the move is intended to support long-term growth, investors reacted negatively to the news.

Applied Materials, a chipmaker, saw its shares rise by 1.2% after reporting better-than-expected second-quarter earnings. The company posted earnings of $2.09 per share, excluding items, on revenue of $6.65 billion. Analysts had anticipated lower earnings and revenue figures. Following the earnings beat, several firms raised their price targets for Applied Materials.

DXC Technology experienced a stock price decline of over 23% after issuing first-quarter earnings and revenue guidance that fell short of expectations. While fourth-quarter results exceeded estimates, the IT company’s weak guidance for the upcoming quarter disappointed investors. DXC Technology expects lower earnings per share and revenue than what analysts had forecasted.

Overall, the stock market has been volatile with various companies experiencing significant price movements based on company-specific developments and market expectations. Investors should closely monitor these developments and consider the implications for their investment decisions.