Disney’s shares dropped by about 1% despite beating analyst expectations in their quarterly results. The media giant reported earnings of $1.39 per share and revenue of $23.16 billion.

Airbnb: Revenue Guidance Disappoints

Airbnb shares took a hit in the premarket, falling nearly 14% due to weaker-than-expected revenue guidance for the third quarter. The company projected revenue in the range of $3.67 billion to $3.73 billion, below analyst forecasts.

Reddit: Exceeding Expectations

Reddit saw a 1% increase in premarket trading after posting second-quarter results that surpassed Wall Street estimates. The company also provided a third-quarter revenue outlook above expectations.

Lyft: Disappointing Revenue Outlook

Lyft’s shares declined by more than 13% as the ride-hailing company issued a third-quarter revenue guidance below analysts’ forecasts. The company expects revenue between $90 million and $95 million.

CVS Health reported second-quarter earnings that exceeded expectations but lowered its full-year profit outlook due to higher medical costs. The drugstore chain’s shares slipped by 0.3%.

Novo Nordisk: Weaker Second-Quarter Results

The Wegovy drugmaker’s shares dropped approximately 4% after reporting weaker-than-expected second-quarter results. The company also reduced its operating profit outlook for the full year.

Rivian: Widening Net Loss

Rivian’s shares fell 9% following a second-quarter report showing a wider net loss compared to the previous year. However, the company managed to beat expectations on some metrics.

Amgen: Tightening Earnings Outlook

Biotech stock Amgen shed 3% after trimming its full-year earnings outlook and posting weaker-than-expected profit for the second quarter. The company cited higher operating expenses for the decrease.

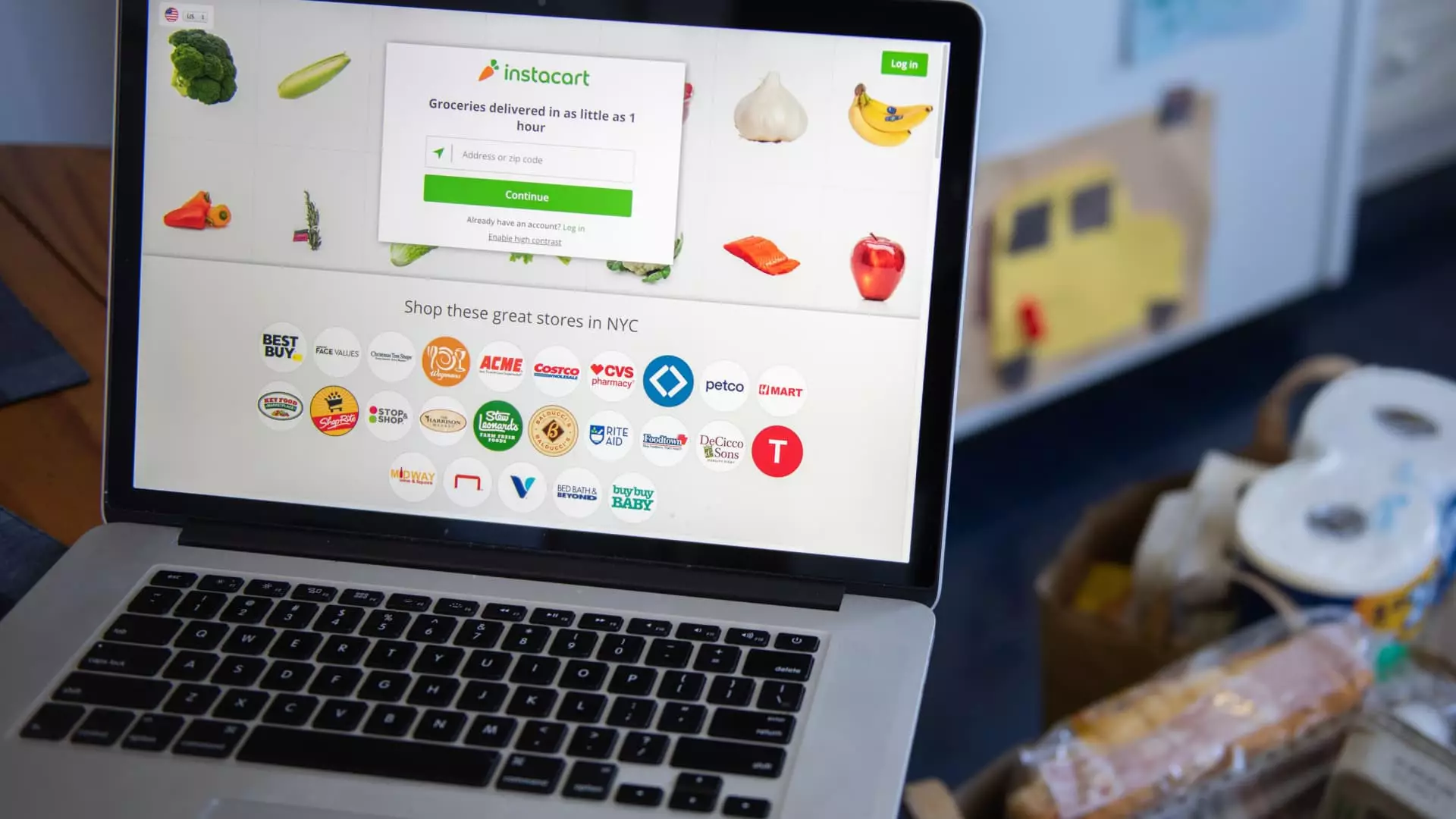

Shares of grocery delivery company Instacart surged over 9% after exceeding revenue and earnings estimates for the second quarter. Earnings of 20 cents per share and $823 million in revenue surpassed analyst predictions.

Super Micro Computer: Missing the Mark

Super Micro’s adjusted earnings fell below analysts’ estimates, leading to a more than 14% drop in shares. The company’s earnings for the fiscal fourth quarter came in lower than expected.

Advanced Micro Devices: Market Optimism

Advanced Micro Devices saw a nearly 2% increase in stock value after Piper Sandler reiterated it as a top pick in the semiconductor industry. Analysts believe the company will gain significant market share in the traditional server space.

Overall, the premarket activity reflected a mix of positive and negative news for various companies, impacting their stock prices before the bell. Investors will be closely watching the companies mentioned for further developments and updates in the upcoming trading sessions.