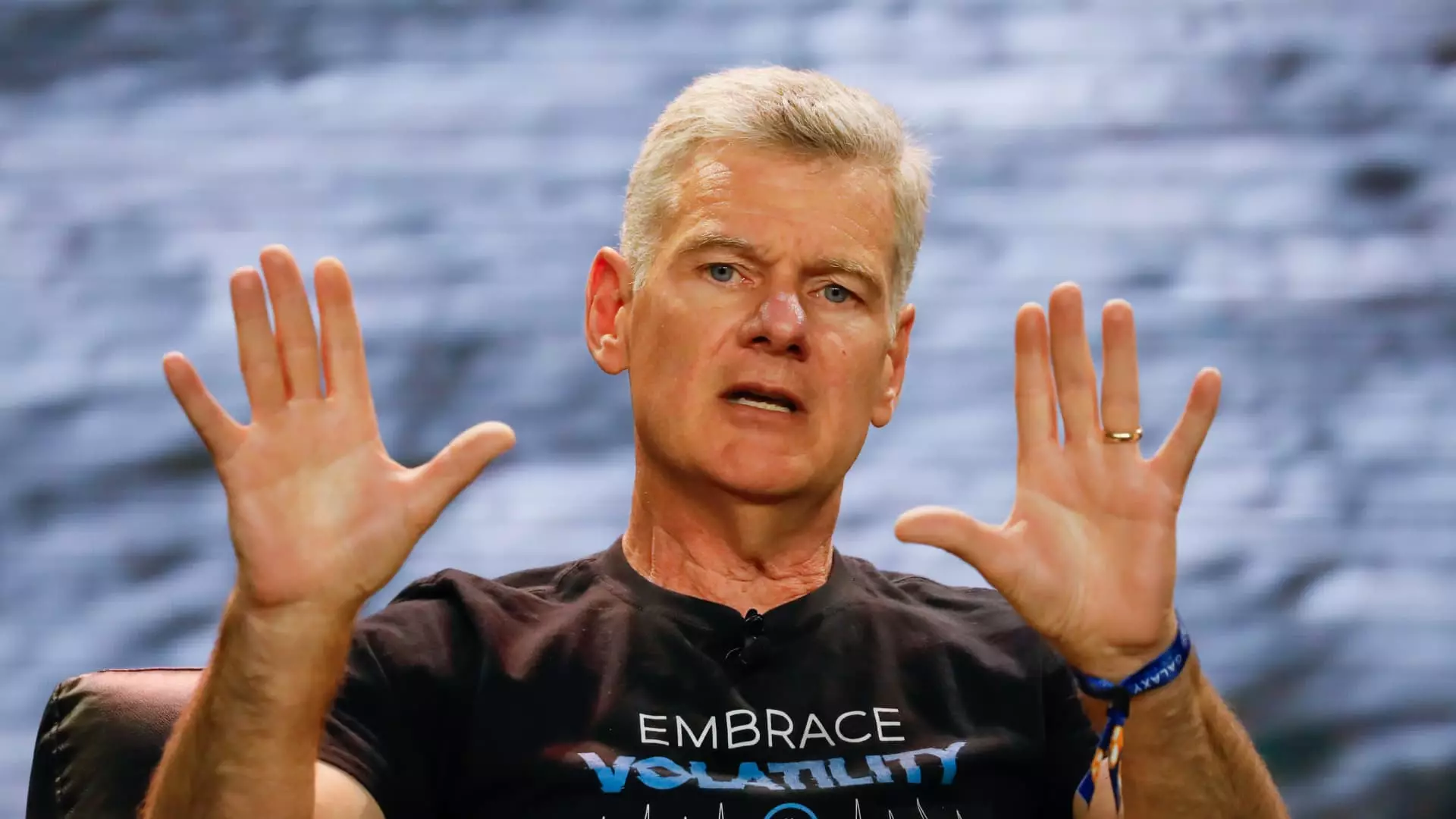

Cryptocurrency expert and hedge fund manager, Mark Yusko, has made a bold prediction regarding the future of Bitcoin. Yusko believes that Bitcoin will more than double this year, reaching an impressive $150,000. This prediction comes as Bitcoin continues to gain momentum in the financial world, with more and more investors becoming interested in this digital asset.

Yusko advises investors to “get off zero” and allocate at least 1% to 3% of their portfolios to Bitcoin. He emphasizes that Bitcoin is the king of cryptocurrencies, and he sees it as a superior alternative to gold. With Bitcoin already up approximately 159% in the past year, Yusko believes that the potential for growth is significant. He predicts that Bitcoin could easily increase by 10x over the next decade.

One of the major factors driving Yusko’s bullish outlook on Bitcoin is the upcoming Bitcoin halving. This event, which is expected to take place in late April, will cut the Bitcoin mining reward in half, thereby limiting the supply of new coins. Yusko anticipates that this supply shock will lead to another round of major tailwinds for Bitcoin. Historically, the price of Bitcoin has peaked about nine months after the halving, before entering a new bear market phase.

Yusko also highlights the recent introduction of Bitcoin exchange-traded funds (ETFs) as a positive development for the cryptocurrency. These ETFs provide investors with an easy way to gain exposure to Bitcoin without directly owning the digital asset. Additionally, Yusko’s firm has exposure to Coinbase, a leading online trading platform for cryptocurrencies. He believes that Coinbase is poised for significant growth, as evidenced by the platform’s remarkable 321% increase in share value over the past 12 months.

Mark Yusko’s optimistic outlook on Bitcoin’s future is supported by a combination of factors, including the upcoming halving, the introduction of ETFs, and the continued growth of platforms like Coinbase. While it is always important to approach investment opportunities with caution, Yusko’s insights provide valuable perspective for investors looking to capitalize on the potential of Bitcoin in 2021 and beyond.