In the last quarter, Berkshire Hathaway’s cash pile swelled to a record $276.9 billion, marking a significant increase from the previous record of $189 billion set in the first quarter of 2024. This surge came as Warren Buffett, the Oracle of Omaha, sold off large portions of stock holdings, including a significant portion of his stake in tech giant Apple. In fact, Buffett sold more than $75 billion in equities in the second quarter alone, bringing the total amount of stocks sold in the first half of 2024 to over $90 billion.

Buffett’s selling spree did not stop in the second quarter, as filings showed Berkshire trimming its second largest stake in Bank of America for 12 consecutive days in the third quarter. This consistent selling of stocks over the past seven quarters has raised eyebrows among investors and analysts alike.

Despite the selling of stocks, Berkshire Hathaway’s operating earnings showed a positive trend in the second quarter of 2024. The conglomerate’s operating earnings, which include profits from fully-owned businesses, experienced a 15% increase to $11.6 billion, up from $10 billion in the same period the previous year. This jump was largely attributed to the strong performance of Geico, the auto insurer that Buffett has praised in the past.

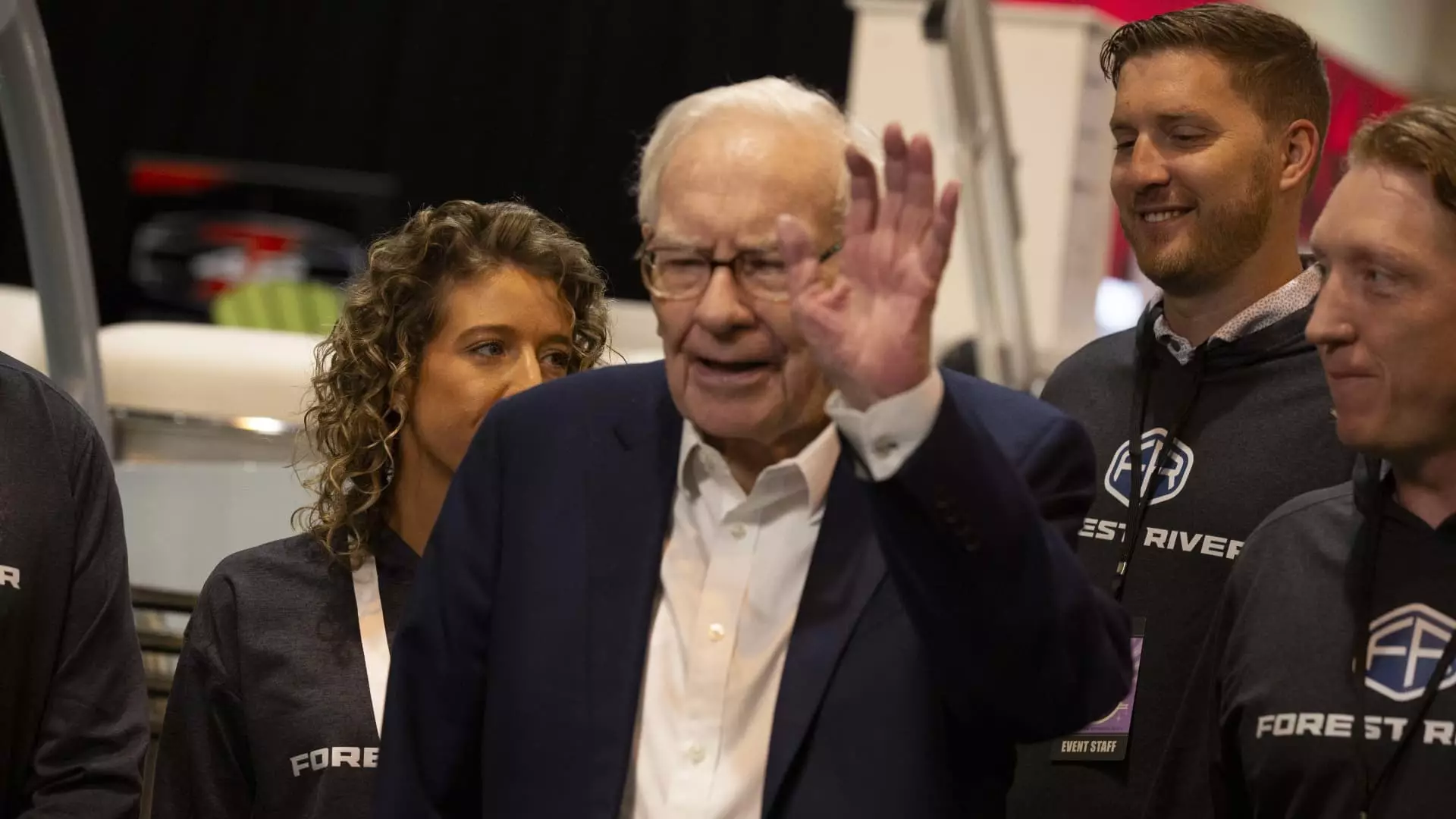

At Berkshire’s annual meeting in May, Buffett admitted that while he is willing to deploy capital, high prices in the market have made him hesitant. He emphasized that any investment made by Berkshire must have minimal risk and the potential for significant returns. This cautious approach has led Berkshire to only buy back $345 million worth of its own stock in the second quarter, a significant drop from the $2 billion repurchased in previous quarters.

The current market conditions have been a source of concern for many investors, with worries over a potential economic slowdown and high valuations in the technology sector. The recent decline of the Dow Jones Industrial average, along with weak economic data, has fueled these apprehensions. Additionally, the surge in the S&P 500, driven by optimism around artificial intelligence innovation, has heightened fears of a market bubble.

Geico, which Buffett once referred to as his “favorite child,” reported a staggering $1.8 billion in underwriting earnings before taxes in the second quarter, a significant increase from $514 million in the previous year. However, Berkshire Hathaway Energy saw a decline in earnings to $326 million, nearly half of the $624 million reported in the same quarter the previous year. The utility business continues to face challenges, including potential wildfire liabilities.

Berkshire Hathaway’s net earnings saw a decline to $30.3 billion in the second quarter, down from $35.9 billion in the same period the previous year. This decrease was attributed to short-term investment gains or losses, reflecting the volatility in the market and Berkshire’s investment portfolio.

Berkshire Hathaway’s cash pile has reached unprecedented levels, driven by Buffett’s strategic selling of stocks. The conglomerate’s financial performance remains strong, but market conditions and economic uncertainties pose challenges for future growth. As Warren Buffett navigates these turbulent times, investors closely watch Berkshire’s next moves and capital allocation strategy.