The Consumer Financial Protection Bureau (CFPB), an agency formed in the wake of the 2008 financial crisis to safeguard consumers against unethical financial practices, finds itself in a precarious situation. Recent developments indicate that this organization is under siege, a reflection of broader political machinations that threaten its very existence. As new leadership attempts to redefine the agency’s operational framework, employees are left grappling with an uncertain future, full of potential layoffs and halted initiatives.

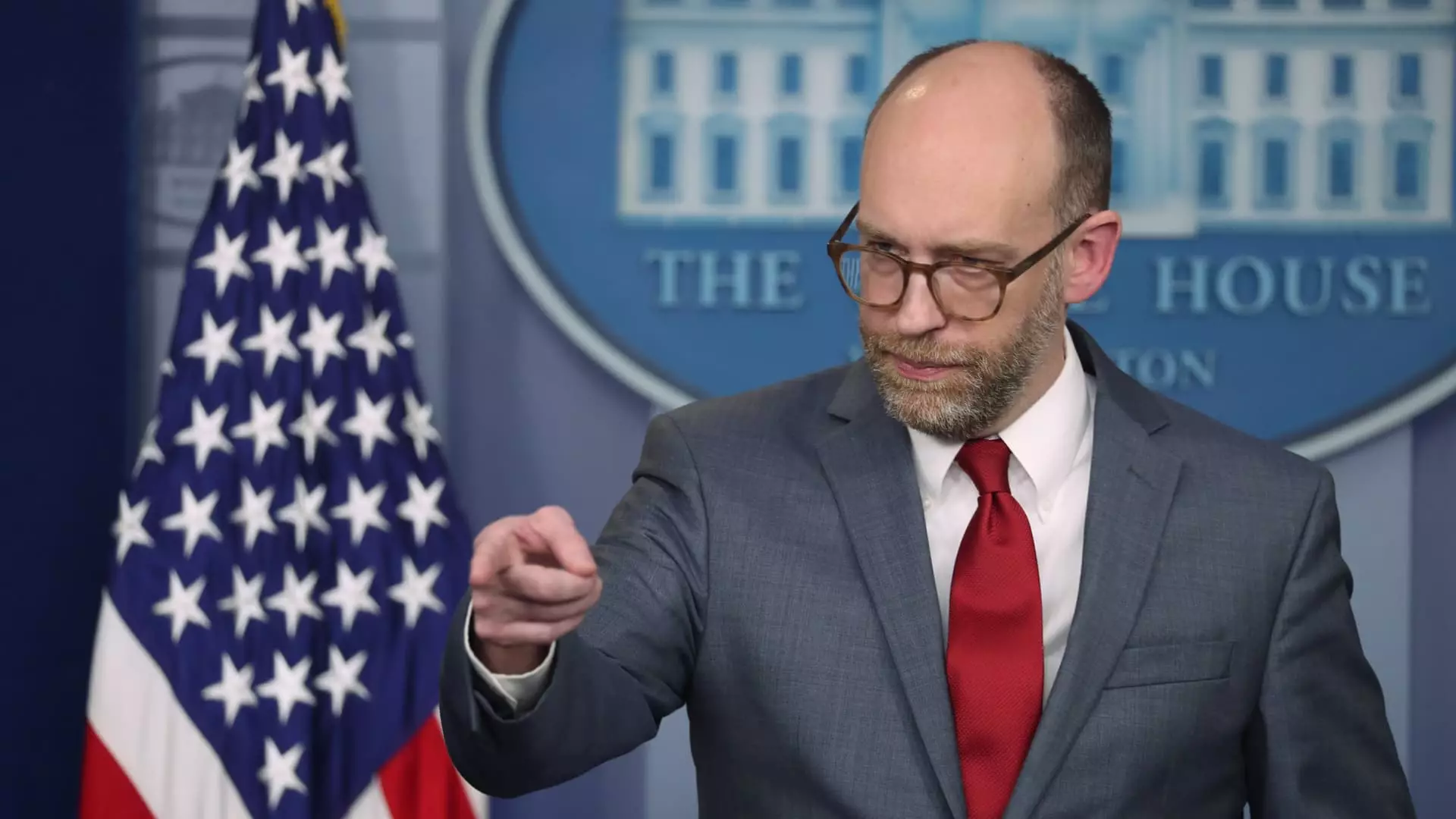

In a recent memo from Adam Martinez, the CFPB’s Chief Operating Officer, employees were instructed to transition to remote work due to the shutdown of their Washington, D.C. headquarters through February 14. This intermission in operations raises eyebrows; it is not merely a temporary setback but signals an overarching strategy of the newly appointed acting director, Russell Vought. His directive to suspend nearly all agency functions sends a clear message: the CFPB is being curtailed just as it was beginning to establish its crucial role in regulating the financial industry. The swift implementation of this operational freeze casts a shadow on the agency’s ability to counteract potentially predatory practices by banking institutions.

The introduction of employees associated with Elon Musk’s DOGE initiative into the CFPB’s ranks further complicates matters. Assumedly brought in to assist with data management or analysis, these operatives reportedly gained access to sensitive CFPB information, including performance reviews. This intrusion raises significant ethical concerns surrounding confidentiality and trust, necessary pillars on which regulatory bodies must operate. Musk’s vocal disdain for the CFPB, including a pointed message posted on his social media channels, exacerbates fears among CFPB employees that the future of the agency itself hangs in the balance.

Vought’s announcement to cut the CFPB’s funding is perhaps the most alarming signal yet about its impending dismantlement. The philosophy guiding this decision seems rooted in a desire to undermine what the administration considers “unaccountability” within the bureau. This perspective ignores the agency’s fundamental role in delivering consumer protections at a time when vulnerable populations need more safeguards against potentially exploitative financial practices. Without proper funding, the CFPB risks losing not only operational vigor but also its ability to enact policies necessary to protect consumers from onerous fees and misleading financial products.

Among the approximate 1,700 personnel working for the CFPB, there exists palpable anxiety regarding job security. Many are bracing for possible administrative leaves or layoffs, which follow patterns previously seen in other agencies facing administrative pushback. The CFPB’s mission delineates clear legal mandates, and, although many positions exist on a discretionary basis, slashing personnel could severely cripple the bureau’s ability to fulfill its core responsibilities. The consequences of massive layoffs could be dire, not just for the agency but for those millions of Americans reliant on its oversight to avoid predatory practices by financial institutions.

Amidst these disconcerting shifts, significant consumer protection initiatives hang perilously in the balance. Proposed measures aimed at capping credit card and overdraft fees, as well as rectifying the reporting of medical debts, could result in substantial savings for millions. These regulations are integral to the CFPB’s mandate to prevent exploitation; they speak directly to the financial vulnerabilities faced by average consumers. The fallout from an operational slowdown could therefore have lasting implications that extend beyond mere statistics—it could negatively impact the well-being of countless individuals who rely on financial stability.

The CFPB’s current predicament illuminates a critical juncture for consumer rights in America. As employees grapple with uncertainty stemming from abrupt leadership changes and funding cuts, the importance of sustaining an independent and empowered regulatory body comes into sharp focus. Policymakers must evaluate the long-term ramifications of undermining the CFPB and recognize that the stability and security of financial markets hinges upon robust consumer protections. As the situation unfolds, advocacy for the CFPB may also become a rallying cry for those committed to safeguarding the financial landscape for future generations.