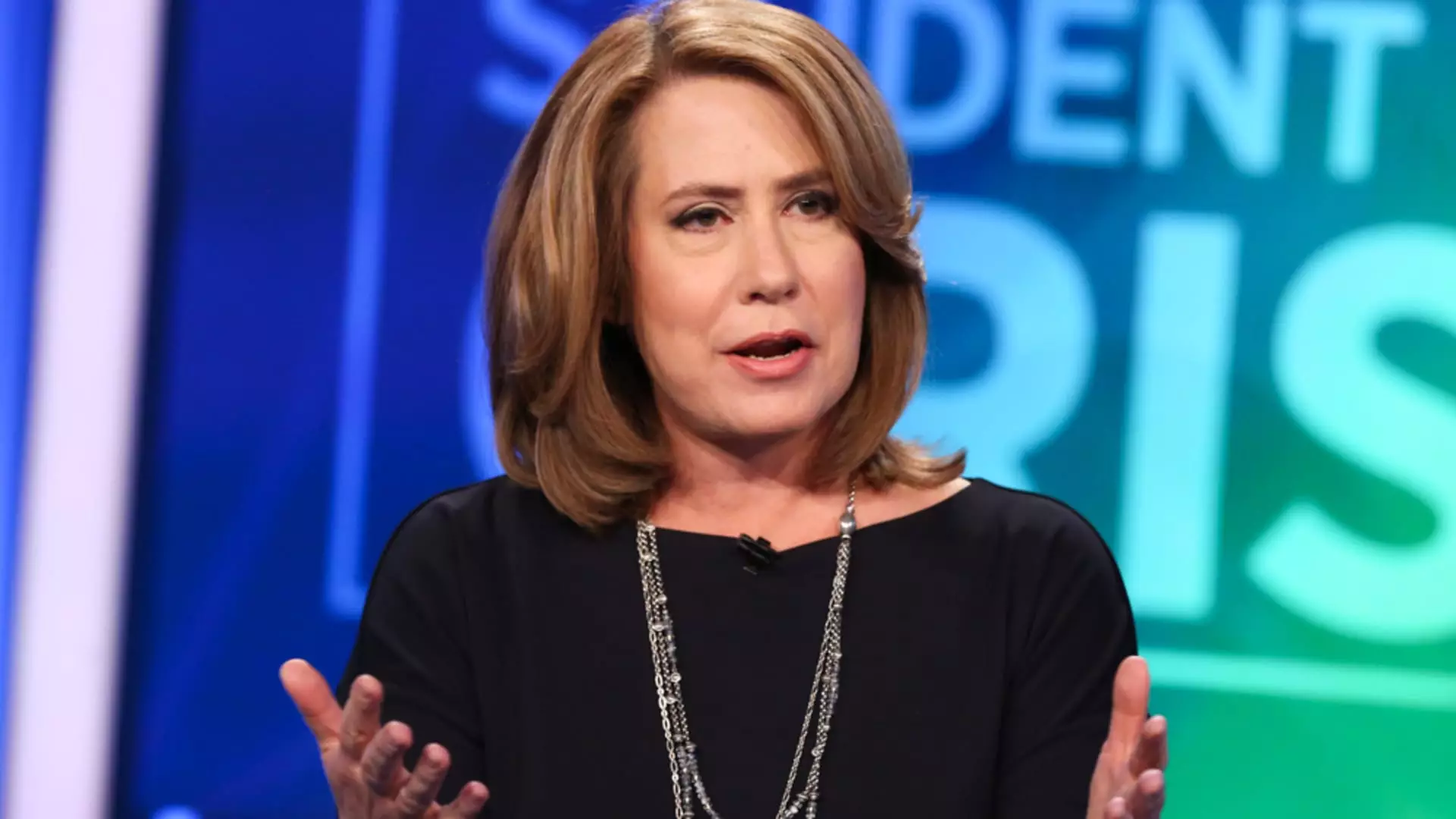

Former chair of the U.S. Federal Deposit Insurance Corp, Sheila Bair, has expressed her concerns regarding the quarterly earnings of regional banks and the vulnerabilities that may be exposed. Bair highlighted that some regional banks are still heavily reliant on industry deposits, have significant exposure to commercial real estate, and face potential instability with uninsured deposits, even for those considered healthy. These issues are reminiscent of challenges faced during the 2008 financial crisis, leading Bair to emphasize the importance of reinstating the FDIC’s transaction account guarantee authority to stabilize deposits.

Regional banks have experienced a difficult year, with the SPDR S&P Regional Bank ETF (KRE) declining by almost 13% and the majority of its members showing negative performance in 2024. New York Community Bancorp stands out as the ETF’s biggest laggard, with a significant drop of over 71%. Other institutions such as Metropolitan Bank Holding Corp, Kearny Financial, Columbia Banking System, and Valley National Bancorp have also seen declines of more than 30%. The overarching concern is the possibility of another shock to uninsured deposits in the event of a bank failure, posing a significant challenge for regional banks.

The recent increase in the benchmark 10-year Treasury note yield to over 4.6% has raised further alarm for regional banks. Bair has pointed out that higher yields could place additional stress on commercial real estate borrowers, a sector where regional banks have substantial exposure. The impending refinancing of commercial real estate loans coupled with rising interest rates could lead to increased borrower distress, affecting loan repayments and overall financial stability.

Opportunities for Larger Financial Institutions

Despite the challenges faced by regional banks, Bair notes that the distress of these institutions can potentially benefit larger money center banks. The shift of business from struggling regional banks to larger financial institutions could create opportunities for the latter to expand their market share and operations. This dynamic highlights the interconnectedness of the financial sector and the potential ripple effects of vulnerabilities within specific segments.

The concerns raised by Sheila Bair regarding regional banks highlight the fragilities within the financial sector. By addressing issues such as reliance on industry deposits, exposure to commercial real estate, and the stability of uninsured deposits, regional banks can work towards strengthening their resilience. Additionally, the potential impact of rising Treasury yields underscores the importance of proactive risk management strategies. As regional banks navigate these challenges, collaboration with regulatory bodies and larger financial institutions could offer support and foster greater stability within the overall financial landscape.