The appointment of Donald Trump Jr. to the board of PSQ Holdings, the parent company of online marketplace PublicSquare, has dramatically altered the company’s financial landscape. On the day of the announcement, shares of PSQ skyrocketed by an astonishing 270.4%, reaching a price of $7.63. This surge highlights how influential figures in business and politics can create significant movements in stock prices, especially for microcap stocks like PSQ. With a market capitalization of only $72 million prior to the announcement, the market’s reaction speaks to the speculative nature of investors and their interest in politically affiliated companies.

PublicSquare positions itself as a commerce and payments platform dedicated to values surrounding “life, family, and liberty.” The company’s ethos is closely aligned with certain conservative ideals, which may explain why investors reacted favorably to Trump Jr.’s involvement. The underlying philosophy of creating a “cancel-proof” economy resonates with an audience that feels increasingly marginalized by mainstream business practices. PublicSquare’s focus on an ideology-driven marketplace could appeal to a growing demographic of consumers advocating for alternative platforms that reflect their values.

Despite the enthusiastic stock gains, it’s crucial to analyze the financial realities of PublicSquare. The company reported revenues of $6.5 million for the September quarter but also experienced significant operating losses exceeding $14 million. This financial imbalance raises questions about the sustainability of the company’s business model and long-term viability. However, the leadership of PSQ, represented by CEO Michael Seifert, is optimistic about the company’s future. Seifert’s statements underline Trump Jr.’s strategic value, reflecting a belief that his experience and network can catalyze growth and improve operational losses.

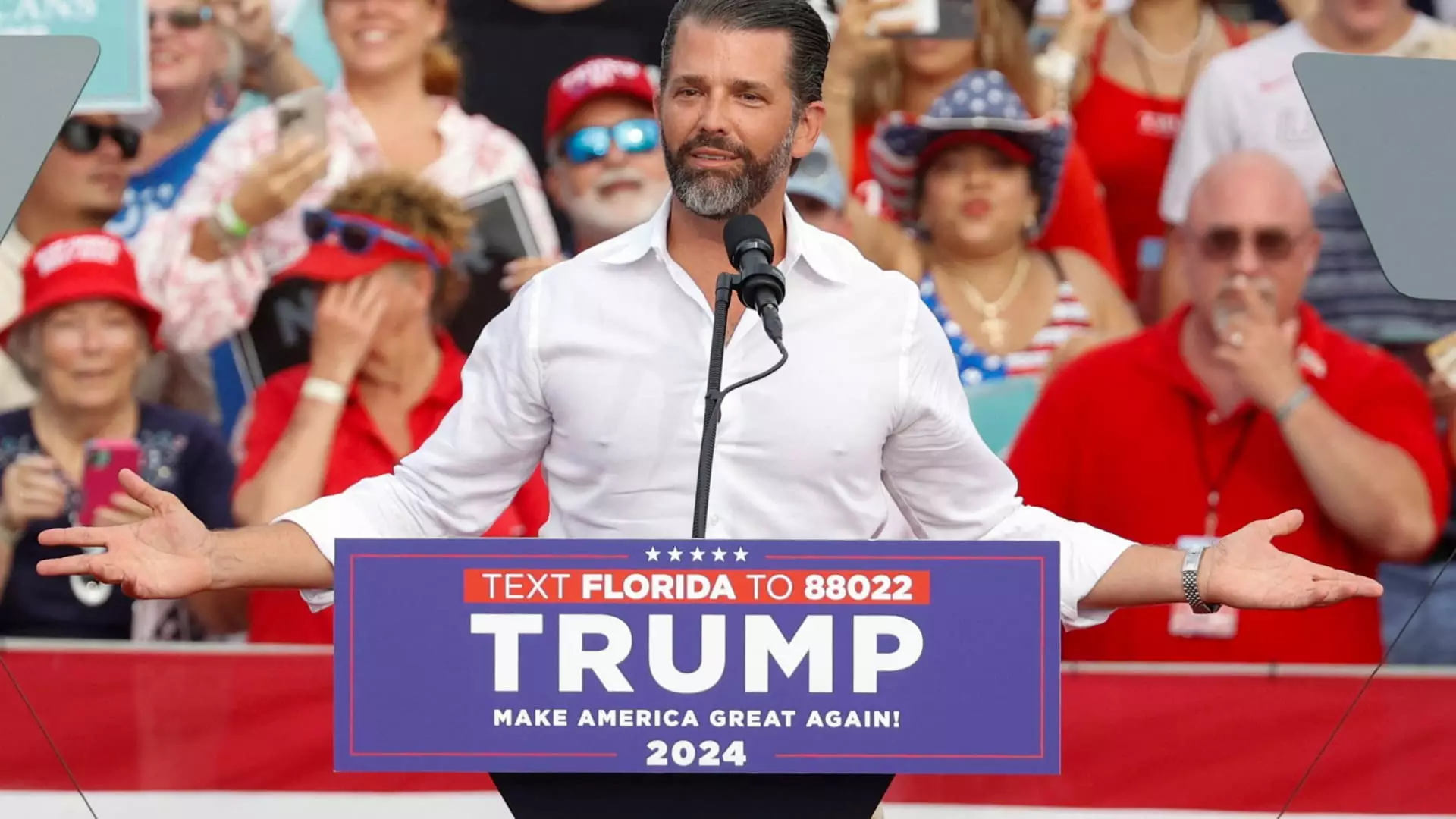

Donald Trump Jr. has recently been expanding his role within the business sector, signaling a shift towards leveraging his name and connections for corporate initiatives. His prior involvement with Unusual Machines—a drone company—also resulted in a remarkable 100% increase in share prices. Furthermore, his partnership with 1789 Capital, a venture firm supporting conservative products, illustrates a strategic pivot towards investing in companies that align with specific political values. Such actions might pave the way for increased visibility and influence within the marketplace.

The addition of notable political figures to corporate boards often leads to speculation about their potential impact on business strategy. As PSQ’s market presence grows, analysts will be watching closely to see if Trump Jr.’s involvement translates to operational improvements and a clearer path to profitability. With launching strategies aimed at conservatives, PSQ may find itself at the center of a burgeoning market niche that prioritizes ideological alignment over traditional business practices. Nevertheless, whether this pivot will yield positive results remains to be seen as the balance between values-driven commerce and financial sustainability is delicate and complex.

While Trump Jr.’s board appointment and the consequent stock surge reflect a potent blend of politics and business, the true measure of PublicSquare’s success will depend on its ability to convert this newfound attention into lasting financial health.