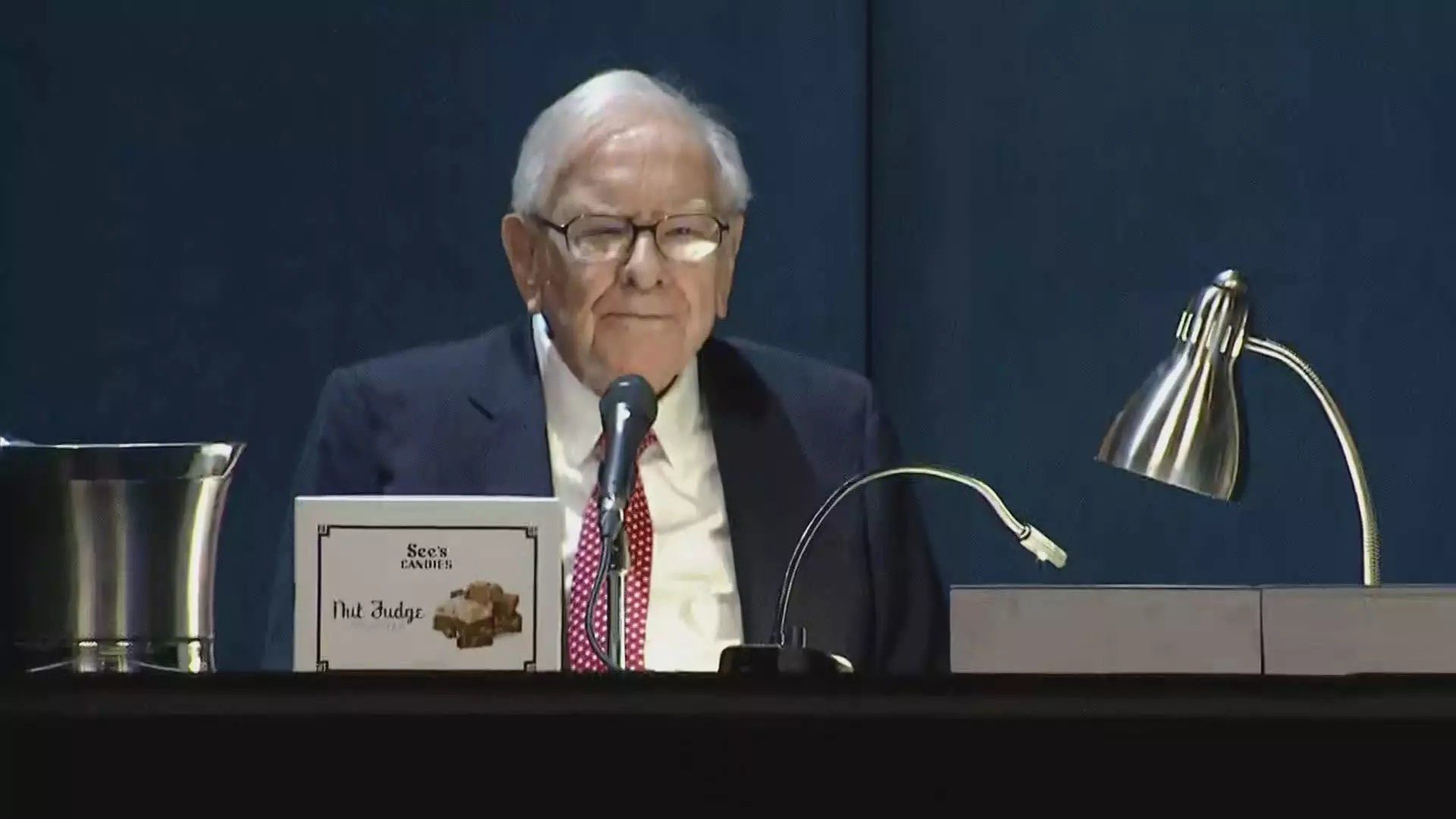

Warren Buffett, the legendary investor, has finally let the cat out of the bag by disclosing his secret stock pick in a recent regulatory filing. The revelation unveiled that Buffett’s conglomerate, Berkshire Hathaway, has purchased nearly 26 million shares of the Zurich-based insurer Chubb. This stake is valued at an impressive $6.7 billion, making Chubb the ninth largest holding in Berkshire’s portfolio as of the end of March. Following the news of Berkshire’s investment, shares of Chubb skyrocketed by almost 7% in extended trading, reflecting investors’ confidence in Buffett’s choice.

The Rise of Chubb and Berkshire’s Influence

Chubb, a renowned property and casualty insurer, gained considerable recognition after the acquisition by Ace Limited in 2016 for a whopping $29.5 billion in cash and stock. The amalgamation resulted in the adoption of the Chubb name by the combined entity. Interestingly, the CEO of Chubb, Evan Greenberg, belongs to a distinguished lineage as the son of Maurice Greenberg, the former chairman and CEO of insurance behemoth American International Group. The consistent growth of Chubb’s stock is evident as it has surged by approximately 12% year to date, reflecting the company’s strong performance and stability in the market.

Berkshire Hathaway, headquartered in Omaha, boasts a significant presence in the insurance sector with a diverse portfolio ranging from auto insurance giant Geico to reinsurance powerhouse General Re, along with an array of home and life insurance services. Notably, Berkshire made a strategic move by acquiring Alleghany, an insurance company, for a hefty sum of $11.6 billion in 2022. This demonstrated Berkshire’s commitment to expanding its foothold in the insurance market. However, the conglomerate recently divested its positions in Markel and Globe Life, signaling a shift in its investment strategy.

What sets Buffett’s recent investment in Chubb apart is the element of secrecy surrounding Berkshire’s purchase. The conglomerate managed to keep this acquisition under wraps for two consecutive quarters, seeking confidential treatment to withhold the details of its stock holdings from public disclosure. Interestingly, speculation was rife among market experts, with many anticipating Berkshire’s mysterious purchase to be a bank stock. Berkshire’s increased cost basis for “banks, insurance, and finance” equity holdings further fueled speculations, hinting at a significant investment in the financial sector. This level of confidentiality is relatively uncommon for Berkshire, with the last instance being the acquisition of Chevron and Verizon in 2020, underscoring Buffett’s strategic maneuvers in the market.

Warren Buffett’s selection of Chubb as his secret stock pick showcases his astute investment acumen and strategic vision in navigating the dynamic landscape of the market. The significant stake in Chubb not only reinforces Berkshire’s position in the insurance industry but also underscores the confidence in Chubb’s growth prospects. As Berkshire continues to evolve its investment portfolio, Buffett’s latest move underscores the importance of secrecy and strategic planning in maximizing returns and sustaining long-term value for shareholders.