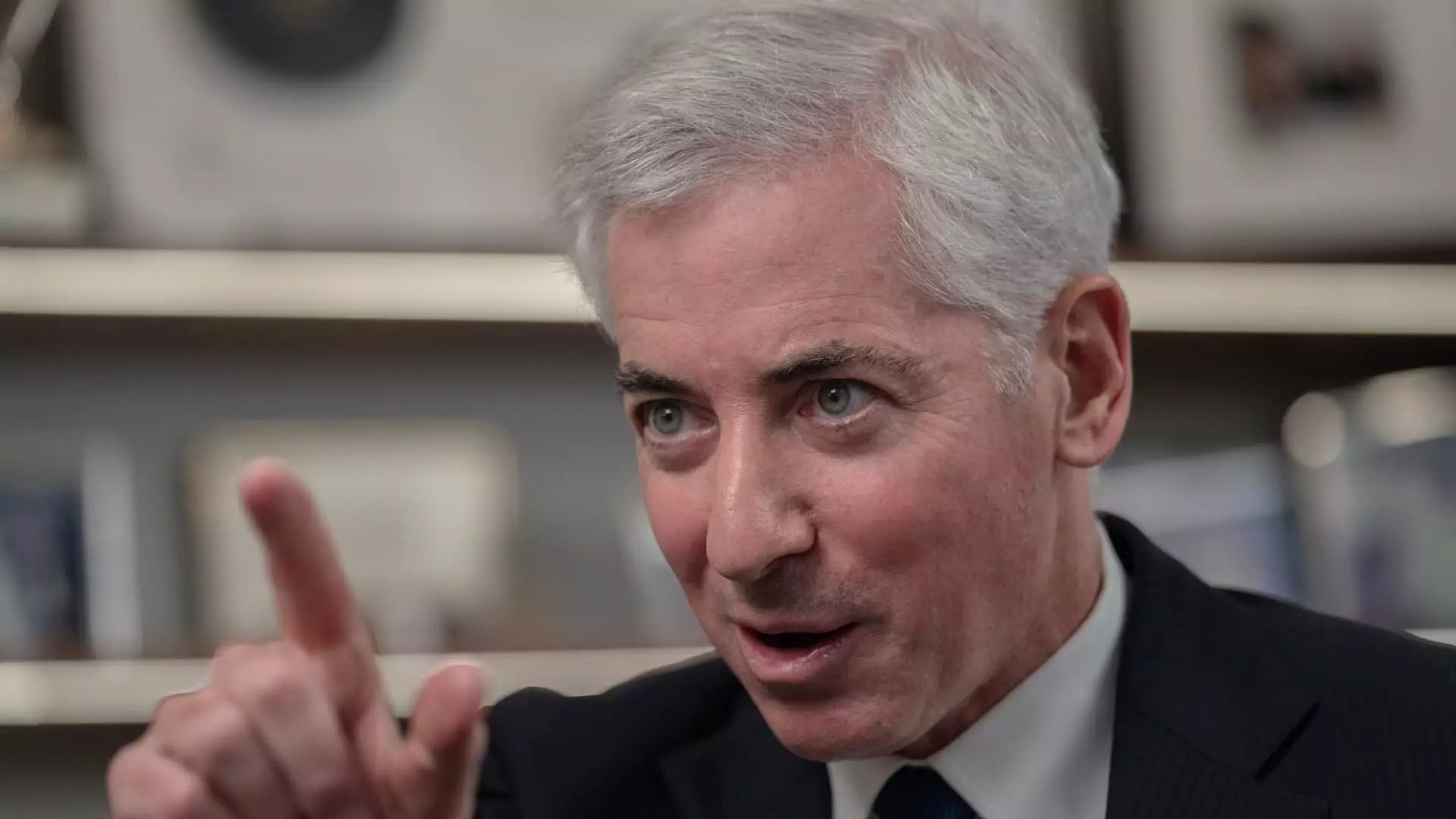

Bill Ackman’s hedge fund, Pershing Square USA, recently withdrew its plans for an initial public offering due to what appeared to be a lack of investor demand. This decision came shortly after the fund announced its intention to raise $2 billion, a significant decrease from the previously speculated $25 billion. Despite the setback, Ackman expressed his commitment to revising the plan and eventually moving forward with the offering.

The withdrawal of the IPO plans also followed a delay notice posted on the New York Stock Exchange’s website, further complicating the situation. Additionally, reports emerged that Baupost Group, a prominent investment firm, opted against investing in the offering after initial interest. This setback was particularly noteworthy as Ackman had previously highlighted Seth Klarman’s involvement in the IPO, which did not come to fruition.

Ackman’s decision to publicly list Pershing Square was likely driven by a desire to capitalize on his increasing popularity among retail investors. His significant following on social media platforms, such as X, provided him with a platform to share his views on various topics, including the U.S. presidential election and antisemitism. By going public, Ackman may have sought to further engage with these audiences and expand his influence in the financial world.

As of June, Pershing Square had $18.7 billion in assets under management, with a majority of the funds held in Pershing Square Holdings, a closed-end fund that primarily operates in Europe. Despite the challenges faced in the IPO process, the firm’s substantial assets indicate a strong foundation for future growth and expansion.

While the withdrawal of Pershing Square USA’s IPO plans may have been a setback, Bill Ackman remains determined to pursue alternative strategies and revisit his approach to the offering. With a substantial asset base and a growing presence among retail investors, Ackman’s vision for the fund’s future remains promising.