In a significant step towards strengthening the United States’ semiconductor manufacturing capabilities, the U.S. Commerce Department has finalized a remarkable $406 million grant directed to Taiwan’s GlobalWafers. This initiative is poised to dramatically enhance domestic production of silicone wafers, particularly the advanced 300-mm wafers critical for modern semiconductors. Located in the heart of Texas and Missouri, these new projects mark the initiation of large-scale wafer production on U.S. soil, signaling a major shift in the semiconductor supply chain that has long been dominated by East Asian companies.

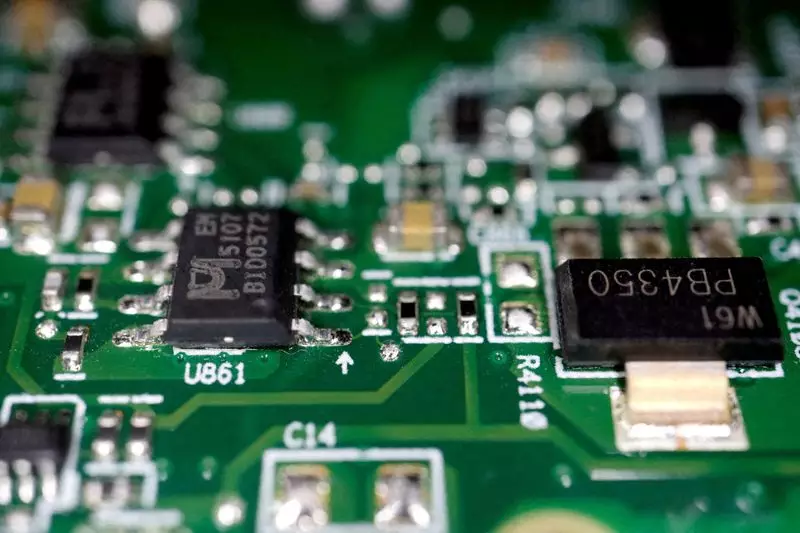

Silicon wafers are foundational to semiconductor fabrication; they serve as substrates for a myriad of electronic devices ranging from everyday consumer electronics to complex systems employed in defense and aerospace applications. The move to bolster domestic wafer production not only aligns with the Biden administration’s agenda to reinvigorate the American manufacturing landscape but also serves as a strategic maneuver to secure the nation’s technological and economic independence. By prioritizing U.S.-based production, the government aims to reduce reliance on foreign manufacturers, thus fortifying national security in an age where technology is increasingly intertwined with geopolitical dynamics.

Previously, GlobalWafers, a leading player in the silicon wafer market, had intended to invest in a facility in Germany. However, the company redirected its focus to Texas, where it plans to establish a $5 billion manufacturing plant dedicated to producing 300-mm wafers. This pivot underscores a growing trend among multinational corporations to reassess their investments in light of evolving market conditions and U.S. commitments to reshoring critical manufacturing capabilities. With substantial state-level investments expected to complement federal grants, GlobalWafers forecasts the creation of 1,700 construction jobs and an additional 880 manufacturing positions, thus contributing to local economies and workforce development.

The current global landscape for silicon wafer production is heavily concentrated, with over 80% of the 300-mm wafer market held by a mere five companies. This monopoly creates vulnerabilities in supply chains, which became glaringly evident during the recent semiconductor shortages that plagued various industries. With GlobalWafers’ impending facilities set to ramp up production in the U.S., competition is likely to intensify, encouraging innovation and potentially lowering costs. Furthermore, the production of silicon-on-insulator wafers will cater to emerging technologies that require advanced semiconductor solutions.

This grant is part of a broader effort stemming from the 2022 CHIPS and Science Act, which allocated an impressive $52.7 billion for semiconductor manufacturing and research in the United States. The urgency surrounding these awards is amplified by the fluctuating political landscape, prompting the Commerce Department to expedite funding allocations before potential changes in leadership. By securing this financial support, the U.S. is not only catalyzing an economic boom in semiconductor production but is also setting the stage for sustained technological advancements.

The collaboration between the U.S. government and GlobalWafers exemplifies a strategic, multifaceted approach to reinstate the U.S. as a formidable player in the global semiconductor arena. It highlights the integral role of robust policy frameworks in shaping the future of technology and manufacturing in America.