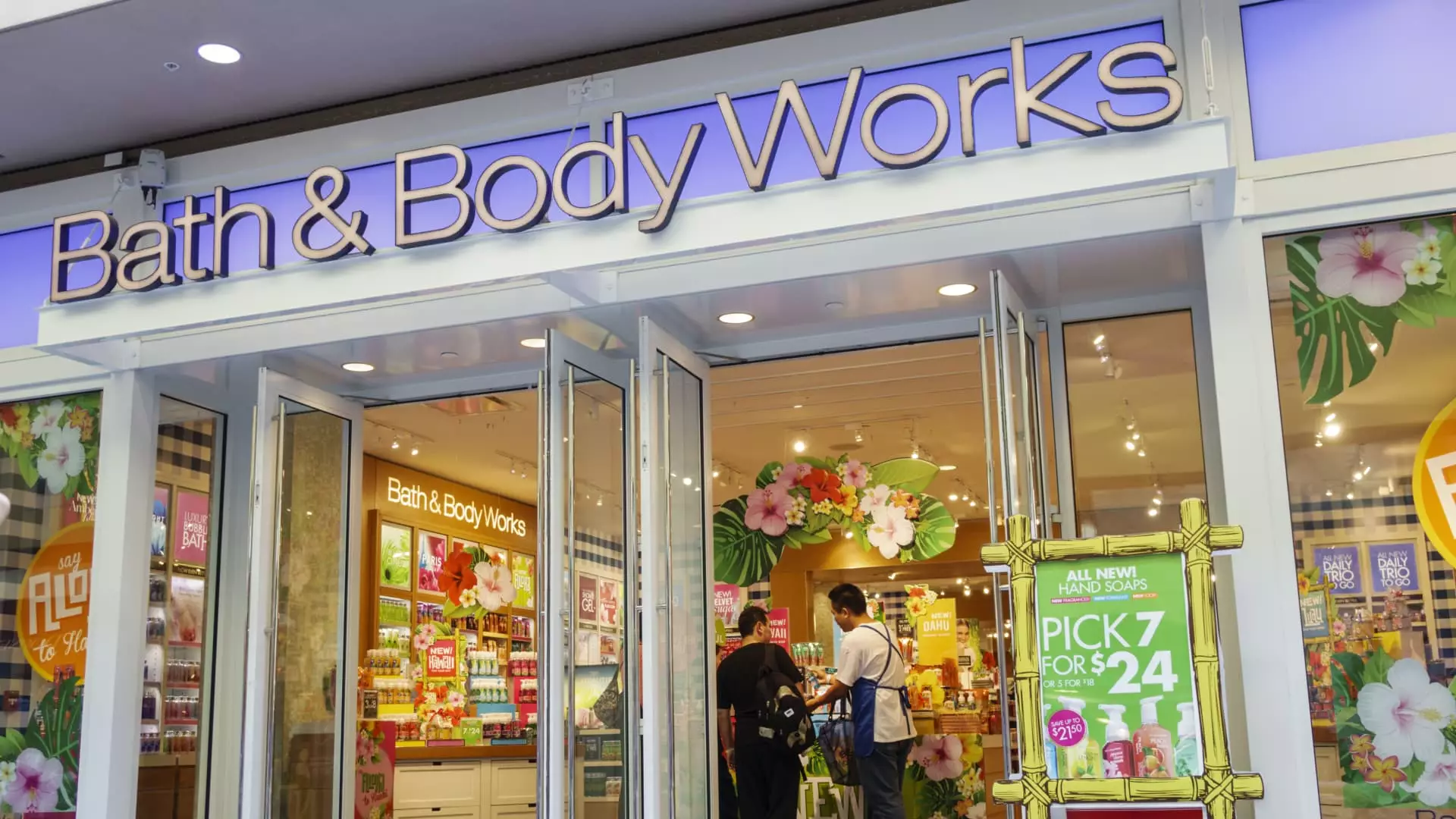

Bath & Body Works recently experienced a significant drop in their stock price, with a 14% decline marking their worst day since 2021. This decline followed the release of first-quarter earnings and revenue that beat estimates, however, the company offered a disappointing outlook for the second quarter. With earnings expected to be lower than anticipated, investors reacted by selling off shares, leading to the sharp decline in stock price.

On the other hand, Carnival saw a positive uptick in their stock price, with shares rising by 4.8%. This increase was driven by the announcement that P & O Cruises Australia would be folded into the Carnival Cruise Line. This strategic move aimed to increase capacity for Carnival's flagship brand and was viewed positively by investors, resulting in the stock price increase.

GameStop, a popular meme stock, experienced a 5% decline following a significant rally the day before. This rally was sparked by GameStop champion Keith Gill, also known as “Roaring Kitty,” who shared his substantial stock and call option positions. However, concerns over market manipulation arose after reports suggested that Gill's brokerage, E-Trade, was contemplating banning him from the platform. This news led to a sell-off in GameStop stock.

Freight company Saia saw a 7.7% increase in their stock price after reporting higher shipments per workday for April and May compared to the previous year. This positive performance also had a spillover effect on other freight companies such as Old Dominion Freight Line and XPO, which saw increases in their stock prices as well.

Maxeon Solar Technologies faced a challenging day in the market, with a 5% drop in their stock price following a downgrade from Goldman Sachs. The investment bank also slashed its price target for the company to $1, citing concerns over debt restructuring and the need for an equity investment from the company's largest shareholder to improve liquidity. This news led to a negative investor sentiment and a decline in stock price.

Oil price pressures weighed on energy stocks, with companies like BP, Exxon Mobil, and Diamondback Energy seeing declines of around 2%. This decline was attributed to OPEC+ announcing plans to phase out production cuts beginning in October 2024 through September 2025, leading to concerns over the supply-demand balance in the energy markets.

Industrial stock Stanley Black & Decker faced a 2.8% decline after Barclays downgraded the stock. Analysts expressed concerns over the company's earnings estimates being too high and anticipated sales and production figures facing downward pressure due to inventory concerns. This downgrade led to a sell-off in the stock.

In contrast, Flutter Entertainment saw a modest increase of more than 1.1% after Oppenheimer initiated coverage with an outperform rating. Analysts highlighted the company's structural advantages in the sports betting and gambling industry, as well as its strong position in the U.S. parlay market, which served as positive catalysts for the stock price increase.

Boot Barn experienced a 3% increase in stock price after disclosing a 1.4% growth in same-store sales in the first nine weeks of the fiscal first quarter. This positive performance exceeded previous guidance for a decline in same-store sales and was well-received by investors, leading to the stock price increase.

Overall, the stock market experienced a mix of positive and negative movements based on company-specific news and broader market conditions. Investors reacted to earnings reports, strategic announcements, and analyst recommendations, driving stock prices in either direction. It is essential for investors to stay informed about these developments to make informed decisions in the market.