As per Jefferies’ latest report, the expected expansion of EBIT margins for IT companies in FY25 may not be as promising as initially anticipated. While there is hope for a substantial improvement in Tech Mahindra, other IT firms may only see a modest rise in margins. The report points out several challenges that could hinder margin growth, one of them being the concerning trend in the employee demographics of major IT companies like Tata Consultancy Services and Infosys. The decreasing share of employees under 30 years old, along with near-peak utilization levels, suggests a less agile and more costly employee structure. This shift towards an older workforce could hamper these companies’ ability to quickly adapt to changing market demands and constrain margin expansion.

Subcontracting Costs Reduction

The report also highlights a significant reduction in subcontracting costs across the IT sector. Currently, subcontracting costs are at their lowest since FY15, making up 9.1% of sales, a substantial drop from their peak in FY22. This cost-cutting effort reflects IT firms’ strategy to trim expenses amid sluggish demand. However, with subcontracting costs already minimized, there may be limited opportunities for further reductions. While companies like Infosys and Tech Mahindra still have relatively higher subcontracting costs compared to their five-year averages, the overall trend suggests that cost-cutting measures may have reached a plateau, impacting margin growth for these companies.

Valuation Issues and Overpricing Concerns

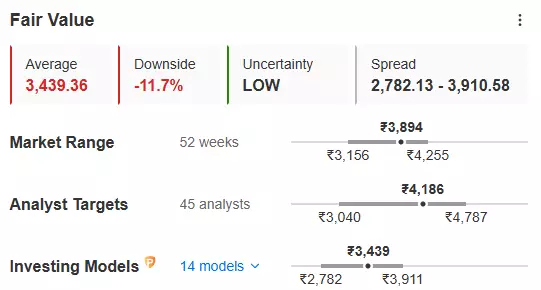

In addition to the challenges posed by employee demographics and subcontracting costs, the report also raises concerns about valuation issues for IT giants like Tata Consultancy Services. According to InvestingPro’s fair value assessment, TCS is currently priced at INR 3,893 per share, while its fair value is assessed at INR 3,439, indicating an overvaluation of 11.7%. This overpricing poses a risk for investors, signaling that the stock may be overvalued. By utilizing fair value metrics that adjust with market developments, investors can make educated decisions about when to consider booking profits and reallocating their investments to companies with more favorable valuation gaps. Jefferies’ analysis underscores the importance of staying informed about fair value assessments to navigate potential risks and optimize investment strategies in the IT sector.

The anticipated margin expansions for IT companies in FY25 may face significant challenges due to factors such as an aging workforce, near-peak utilization levels, and already minimized subcontracting costs. These issues, compounded by valuation concerns for major players like TCS, highlight the need for investors to stay vigilant and informed about market trends and fair value assessments. By understanding and addressing these challenges, investors can navigate the complexities of the IT sector and make informed decisions to maximize their investment potential.