Amidst the ongoing Q4 FY24 earnings season, Goldman Sachs analysts have conducted a thorough recalibration of their projections for the Indian pharmaceutical sector. This recalibration takes into account a wide spectrum of variables, ranging from monthly sales data to currency fluctuations. One of the key observations made by the analysts is that the sector is currently trading at valuations that exceed one standard deviation above its five-year average. This upward trajectory in valuations is largely fueled by the resilience demonstrated by major players in the industry, such as Sun Pharma, Cipla, and Divi's Laboratories.

Goldman Sachs, in their latest report, highlights the pivotal significance of management commentary on various factors that are expected to shape the future of the sector. Some of the key areas of focus include the trajectory of domestic market expansion, trends in US generic drug pricing, and the outlook for margins in the fiscal year 2025. The analysts have maintained a bullish stance on select stocks, including Syngene, Neuland, Torrent Pharma, Aurobindo, Gland, and Biocon. However, they have expressed reservations regarding Laurus, Cipla, and Sun Pharma.

1. **Domestic Market Dynamics**: Despite experiencing a modest uptick in base volume growth, the sector continues to benefit from stable pricing dynamics and recent patent expirations, which are driving new product momentum. The forthcoming management guidance on volume growth sustainability and the impact of pricing adjustments in the National List of Essential Medicines (NLEM) portfolio will be critical for investors to monitor.

2. **US Generic Pricing**: Concerns related to base-business erosion have somewhat subsided, as Goldman Sachs points out the transitory nature of the current pricing environment. The analysts anticipate a stabilization in price erosion at mid-to-high single digits, a trend that is expected to positively impact companies like Aurobindo and Gland.

3. **Margin Outlook**: The sector has recently witnessed robust gross margins, which are projected to persist in the coming fiscal year. However, potential headwinds from input cost escalations could pose challenges. Management commentary on cost dynamics, especially in the midst of a volatile commodity price environment, will be closely watched.

It is noteworthy that Goldman Sachs has revised their earnings estimates, taking into consideration recent market developments and rolling forward valuation bases. This revision includes adjustments to target prices, with top picks identified as Torrent Pharma for its structural exposure, Aurobindo for its tactical US generics play, and newcomers Syngene and Neuland. Conversely, downward revisions have been made for Laurus, Cipla, and Sun Pharma, owing to specific factors impacting earnings projections.

How can investors discern the right stocks from a long list of options provided by astute analysts? The following framework can serve as a valuable guide for making well-founded investment decisions:

1. **Track Recommendations**: Keep a close eye on stocks that have been upgraded by reputable giants like Morgan Stanley and Goldman Sachs.

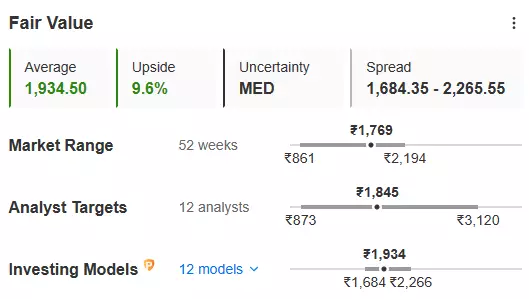

2. **Assess Fair Value**: Determine the real valuation of a stock, also known as fair value, to understand the estimated upside potential that remains.

3. **Select Potential Stocks**: Choose 2-3 stocks with the highest potential to add to your portfolio.

The Indian pharmaceutical sector presents a landscape of opportunity and challenge for investors. By closely analyzing the insights provided by analysts like Goldman Sachs and leveraging tools like InvestingPro for real-time stock valuations, investors can navigate the market with greater confidence and make informed investment decisions. As the sector continues to evolve, staying attuned to the latest trends and projections will be essential for success in the dynamic world of pharmaceutical investments.