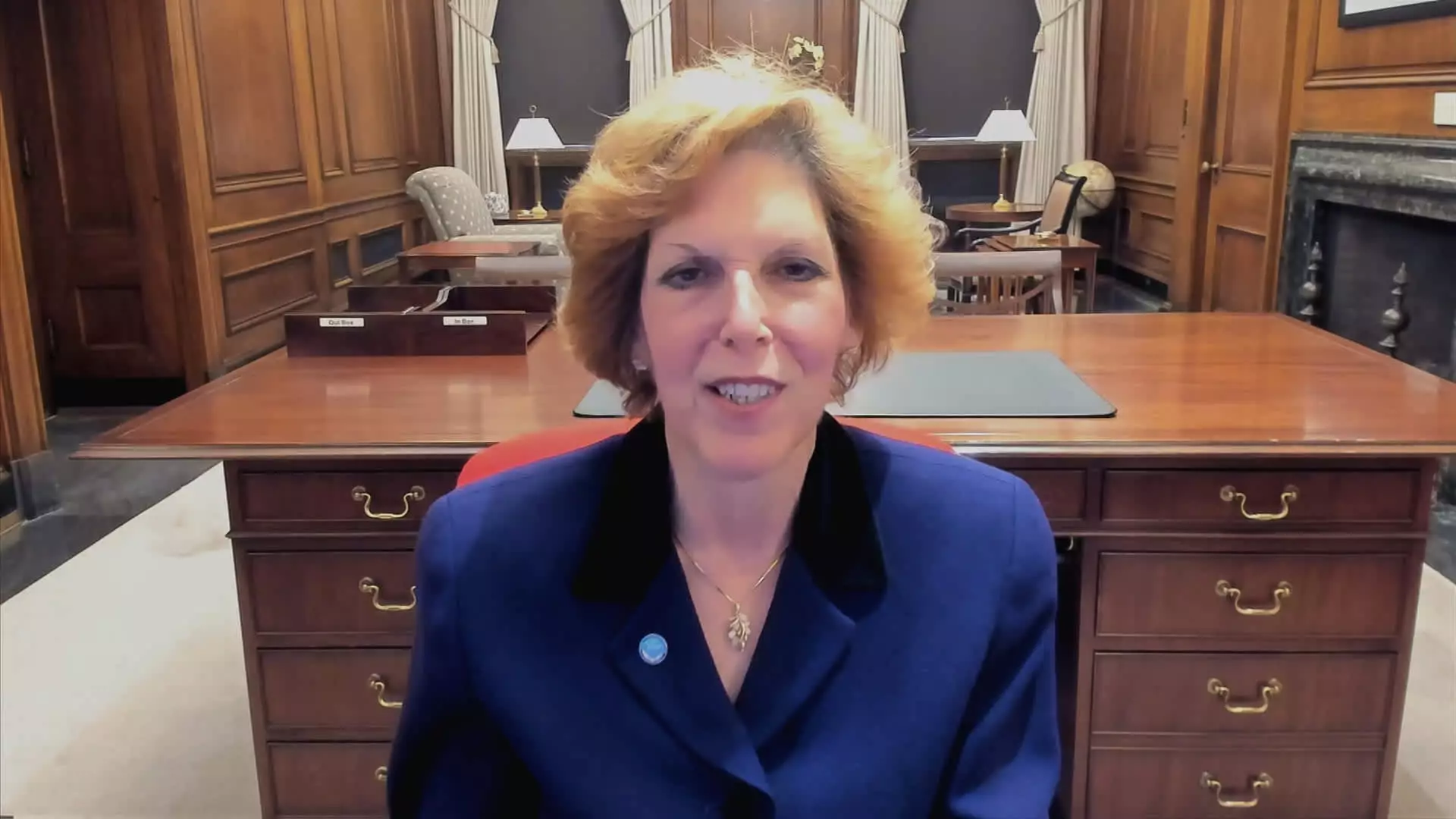

Federal Reserve President Loretta Mester remains optimistic about potential interest rate cuts this year, despite ruling out the possibility of cuts at the next policy meeting in May. She emphasizes the importance of data in shaping her confidence in the trajectory of inflation, indicating that her perspective on rate cuts is reliant on the progress made in this area. The long-term forecast for interest rates, according to Mester, is higher than previously anticipated by policymakers, suggesting a cautious approach to decision-making.

San Francisco Federal Reserve President Mary Daly echoes Mester's sentiments regarding potential rate cuts, emphasizing the need for concrete evidence of subdued inflation before any decisions are made. While Daly expects cuts to occur this year, she maintains that timing and extent are contingent on the evolving economic landscape. Her projection of three rate cuts as a reasonable baseline highlights the uncertainty surrounding the Fed's approach to monetary policy.

The Federal Open Market Committee's recent decision to hold the overnight borrowing rate steady reflects a collective sentiment that more evidence is required to support a shift in interest rates. Mester's acknowledgment of the need for additional inflation data underscores the cautious stance adopted by policymakers. The prospect of three rate cuts this year, as suggested by Daly, further complicates the path forward for the FOMC.

Mester's assessment of the long-run federal funds rate introduces a new perspective on interest rate policy, indicating a potential departure from the traditional 2.5% expectation. Her emphasis on the neutral rate as a guiding principle for policy decisions reflects a desire to balance economic growth with inflation concerns. The evolving projections for the long-rate rate highlight the diverse range of opinions within the FOMC regarding the optimal approach to interest rate adjustments.

As the Federal Reserve contemplates the possibility of rate cuts, the economic landscape remains uncertain, with inflation data playing a crucial role in shaping future decisions. The departure of voting members like Mester introduces a new dynamic to the decision-making process, influencing the overall direction of monetary policy. The challenge of calibrating policy to economic developments while avoiding drastic measures underscores the delicate balance that the Fed must maintain.

The path forward for the Federal Reserve in terms of interest rate cuts is fraught with challenges and uncertainties. While policymakers like Mester and Daly convey optimism about the potential for rate adjustments, the need for solid evidence and cautious decision-making looms large. The evolving projections for long-term interest rates and the implications for monetary policy underscore the complexity of the Fed's mandate. As the economic landscape continues to evolve, the Fed must navigate carefully to ensure a balanced and sustainable approach to managing interest rates.