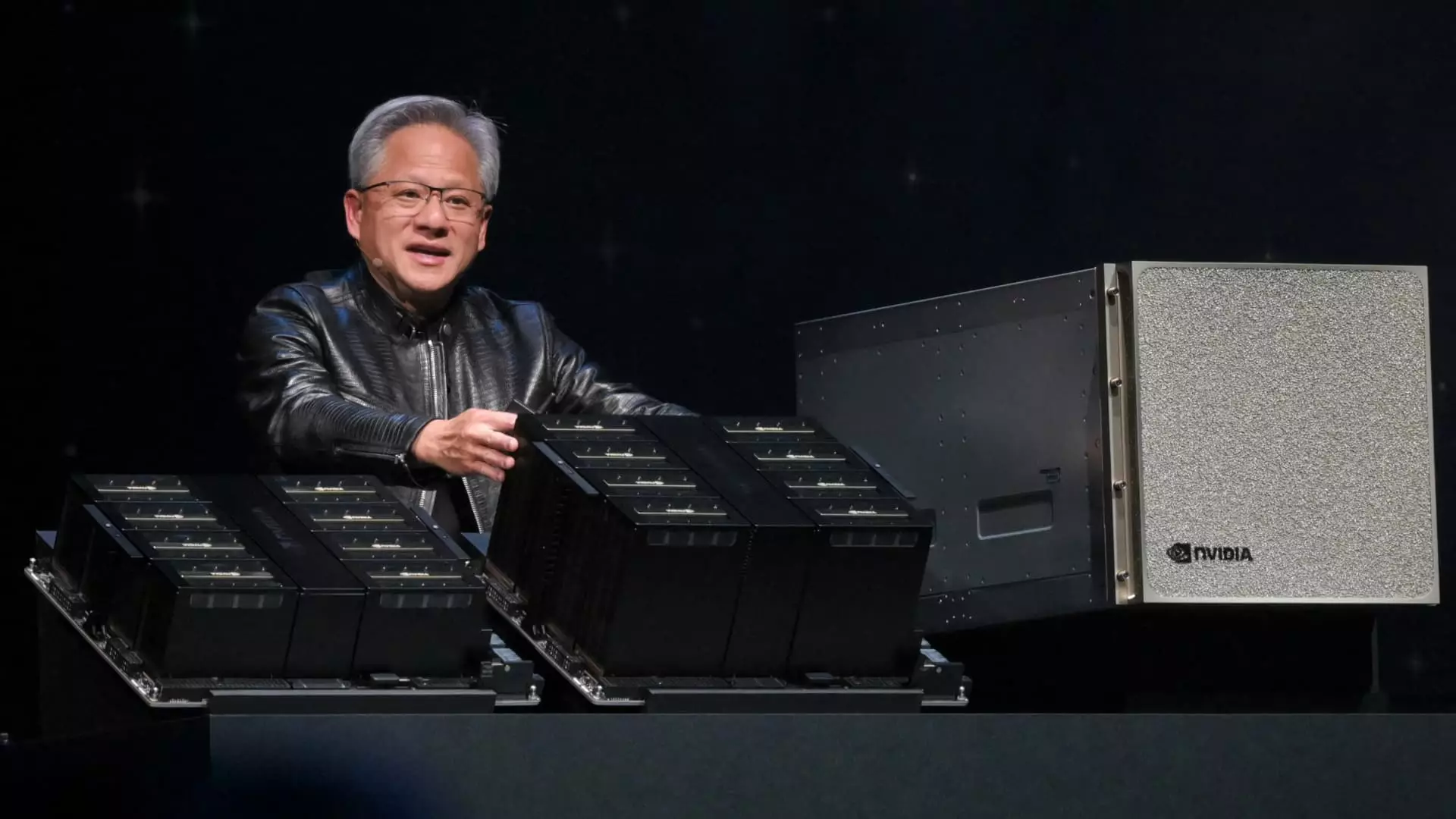

Nvidia CEO Jensen Huang attributes the company’s success in the artificial intelligence chip market to a strategic bet made over a decade ago. This bet involved significant investment in AI technology, totaling billions of dollars, as well as the recruitment of a team of thousands of engineers dedicated to advancing AI capabilities.

During Nvidia’s recent shareholder meeting, Huang highlighted the company’s dominant position in the AI chip market, which has led to a surge in stock value and increased interest from investors. Nvidia’s stock has seen a remarkable 193% increase, with the company surpassing a $3 trillion valuation and briefly becoming the most valuable company in the U.S.

Despite Nvidia’s strong market position, competition in the AI chip industry is intensifying, with traditional chipmakers and startups releasing products to challenge Nvidia’s more than 80% market share. To address this competition, Nvidia is focused on maintaining its position by expanding into new markets such as industrial robotics and strengthening partnerships with computer makers and cloud providers.

Huang emphasized that Nvidia’s AI chips offer the “lowest total cost of ownership” due to their superior performance and cost-efficiency compared to other options on the market. While competitors may offer lower prices, Nvidia’s chips provide better value in terms of overall performance and operational costs, making them a more economical choice for customers.

Nvidia has established a “virtuous circle” in the technology industry, where its platform has a large user base that drives continuous improvements and attracts more users. By partnering with major cloud providers and computer makers, Nvidia has created a broad and attractive install base for developers and customers, enhancing the value of its platform in the market.

Nvidia shareholders have expressed satisfaction with the company’s performance, as evidenced by the approval of a non-binding vote on executive compensation. CEO Jensen Huang received a compensation package of approximately $34 million during the company’s 2024 fiscal year, reflecting a 60% increase from the previous year. Huang’s compensation includes a combination of salary and restricted stock units.