In the evolving domain of the music industry, Reservoir Media stands as a beacon of innovation and strategic foresight. Operating primarily through two distinct segments—Music Publishing and Recorded Music—Reservoir has carved out a significant niche that emphasizes the longevity and sustainability of music royalties.

Reservoir Media operates its business through a bifurcated model that allows it to maximize revenue from two primary avenues. The Music Publishing segment focuses on acquiring interests in music catalogs and signing songwriters, ensuring a continuous influx of royalty earnings. This business line has seen considerable growth, reflecting a broader trend in the music industry toward valuing catalog ownership and the potential for long-term revenue streams.

The Recorded Music segment complements this by acquiring sound recording catalogs, discovering new artists, and promoting existing ones. This cohesive strategy not only diversifies the company’s revenue sources but also helps to buffer against the volatility often associated with individual artist performances. Noteworthy names in their catalog, like Joni Mitchell and John Denver, exemplify the stability and prestige of Reservoir’s portfolio, which comprises over 150,000 copyrights and 36,000 master recordings.

Despite the promising performance indicators, Reservoir Media’s financial trajectory reveals a complex picture. In its post-IPO phase, Reservoir has demonstrated robust year-over-year growth, with gross profits almost doubling from $47.39 million to $89.38 million. This upward trend in earnings reflects the wider industry’s shift towards subscription streaming—a rapidly growing sector projected to generate around $14 billion in revenue, accounting for a significant portion of Reservoir’s income.

However, this growth has not translated into favorable stock market performance. Since its debut through a SPAC merger in July 2021, Reservoir’s stock has fallen 22.24%. This paradox highlights a disconnection between actual business performance and market valuation, raising questions about investor confidence in the company’s long-term growth prospects.

The arrival of Irenic Capital Holdings as an activist investor has introduced a new layer of scrutiny into Reservoir’s operations. Founded by seasoned finance professionals, Irenic is known for leveraging strategic activism to enhance shareholder value. Their recent recommendation for Reservoir to conduct a strategic review has sparked discussions surrounding potential restructuring or even a sale of the company.

While such activist interventions can sometimes be criticized as shortsighted, the unique context of Reservoir’s business structure warrants closer examination. As a company more akin to a collector of royalties—much like a bond collector receiving coupon payments—there is a compelling argument that exploring strategic options could be beneficial for long-term stakeholders. Given the nature of its asset acquisition strategy, Irenic’s focus on optimizing the company’s capital structure might be precisely what Reservoir needs.

Reservoir’s current market positioning raises interesting comparisons with its peers. Trading at approximately 8-9 times net publisher’s share (NPS), it lags behind competitors who frequently command higher multiples, often in the mid to high teens. This differential suggests that, for Reservoir to attract a strategic buyer—the ideal scenario—it would need to enhance its valuation metrics to align more closely with prevailing industry standards.

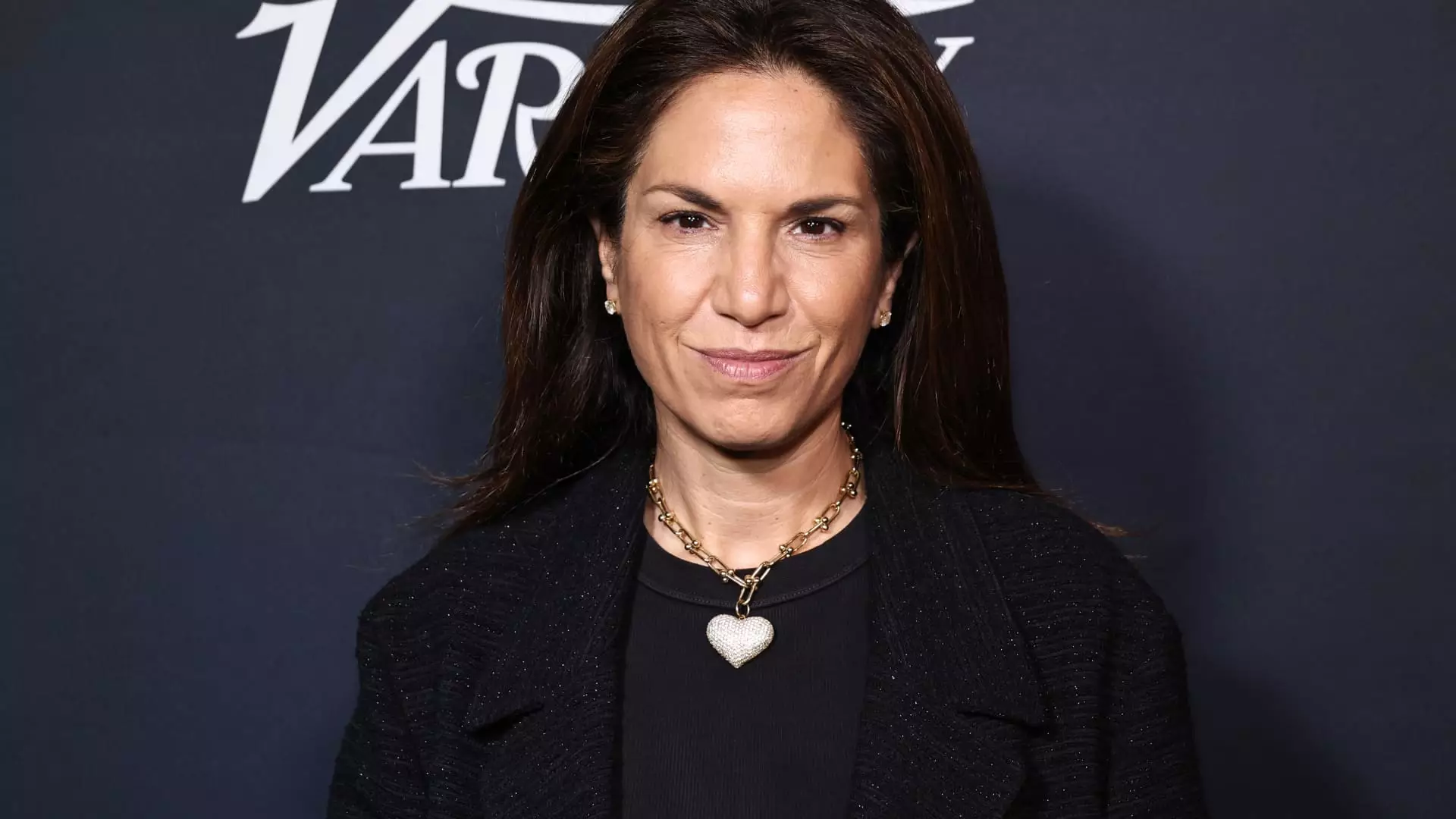

Moreover, the existing shareholder structure complicates matters. With significant stakes held by the Khosrowshahi family, Irenic, and Richmond Hill Investments, any transition to a private structure would necessitate coordinated action among these stakeholders. The familial ties and high caliber of leadership within Reservoir, particularly under CEO Golnar Khosrowshahi, provide a strong rationale for maintaining continuity rather than dismantling existing leadership.

The future of Reservoir Media hinges on its ability to adapt in a changing music industry landscape. With a strong catalog that includes timeless hits, the brand’s value is intrinsically linked to the continued demand for classic music as well as emerging trends in consumption. Furthermore, strategic decisions influenced by activist stakeholders could propel Reservoir into a new phase of growth.

Ultimately, while challenges linger, the opportunities for strategic expansion and increased market positioning remain robust. By capitalizing on its unique assets, refining its business strategy, and enhancing shareholder engagement, Reservoir Media could very well resonate as a formidable player in the ever-evolving world of music publishing and rights management.